Buying a home is a significant milestone in our lives, and it’s crucial to protect this valuable investment against unforeseen events. While the future can be unpredictable, one way to safeguard your home is through the power of home insurance. From ensuring your property to protecting your belongings, home insurance offers a sense of security and peace of mind that is priceless.

But with numerous insurance options available in the market, understanding the intricacies of home insurance can feel like navigating a maze. Whether you’re a first-time homeowner or already have an insurance policy, it’s important to unravel the secrets of home insurance to make informed decisions about your coverage. In this comprehensive guide, we will delve into the world of home insurance, demystifying its key components and shedding light on the protection it offers. From commercial auto insurance to life insurance, we will explore how home insurance fits into the broader insurance landscape, ensuring you have a holistic understanding of how to safeguard your home effectively. So let’s embark on this insightful journey together and unlock the secrets to making the most of your home insurance coverage.

Understanding Home Insurance

Home insurance is a vital investment for every homeowner. It provides financial protection against unexpected damages and losses that may occur to your property. Understanding the ins and outs of home insurance can help you make informed decisions when selecting the right policy for your needs.

When it comes to home insurance, there are typically two main types of coverage: property coverage and liability coverage. Property coverage protects the physical structure of your home, as well as any personal belongings inside it, against perils such as fire, theft, or natural disasters. On the other hand, liability coverage offers protection in case someone gets injured on your property and decides to take legal action against you.

It’s also worth noting that home insurance policies can vary in terms of coverage limits and deductibles. Coverage limits refer to the maximum amount your insurance provider will pay if you file a claim, while deductibles are the out-of-pocket expenses you must pay before your insurance coverage kicks in.

In addition to the standard coverage options, many home insurance policies also offer optional add-ons or endorsements. These may include coverage for specific valuable items, such as jewelry or art, or additional coverage for certain perils not included in the standard policy.

By having a comprehensive understanding of home insurance and its various components, you can ensure that your most valuable investment is adequately protected. Taking the time to compare different policies and seek guidance from insurance professionals can help you find the perfect insurance plan that meets both your needs and budget.

Exploring Commercial Auto Insurance

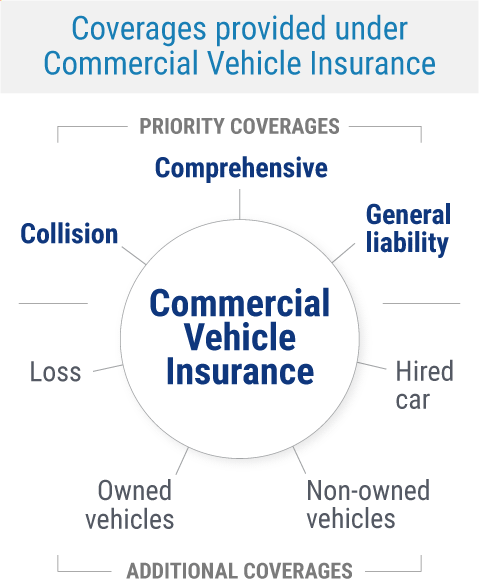

In addition to protecting your home and your life through insurance coverage, it is essential to understand and consider the benefits of commercial auto insurance. This type of insurance is designed specifically for businesses that rely on vehicles to carry out their operations.

Commercial auto insurance provides coverage for vehicles used for business purposes, such as delivery vans, company cars, and trucks. It safeguards your business against financial losses that may arise from accidents, theft, or damage to your commercial vehicles.

By securing the appropriate commercial auto insurance policy, you ensure that your business is protected from liabilities associated with accidents involving your company vehicles. Such coverage typically includes bodily injury liability, property damage liability, medical payments, collision coverage, and comprehensive coverage.

In the event of an accident, having commercial auto insurance can help cover the costs of medical expenses, vehicle repairs, or even legal fees. It not only safeguards your business assets but also provides peace of mind knowing that your vehicles and drivers are adequately protected.

Understanding the specific needs and risks of your business is crucial when selecting commercial auto insurance. By working with an insurance agent who specializes in this type of coverage, you can tailor the policy to suit the unique requirements of your business and ensure comprehensive protection.

Remember, commercial auto insurance plays a vital role in safeguarding your business against unforeseen circumstances and potential financial losses. It is crucial to explore the various options available and choose the best policy that meets your specific needs.

Securing Your Future with Life Insurance

General Liability South Carolina

Life insurance is an essential tool when it comes to protecting your family’s financial future. It offers a sense of security and peace of mind knowing that your loved ones will be taken care of in the event of your passing. With life insurance, you can ensure that your family is financially protected and able to maintain their lifestyle, even when you’re no longer around.

One of the primary benefits of life insurance is the death benefit it provides. This is the amount of money that is paid out to your beneficiaries upon your death. The death benefit can be used by your loved ones to cover various expenses, such as funeral costs, outstanding debts, and daily living expenses. It can also help replace your income, ensuring that your family can maintain their current standard of living.

Another important aspect of life insurance is its ability to offer financial stability during challenging times. If you have dependents who rely on your income, life insurance can provide them with the support they need in the event of your unexpected passing. It can help them continue paying for essential expenses like mortgage payments, education costs, and healthcare expenses, offering them a financial lifeline during an already difficult period.

Moreover, life insurance can also serve as an excellent financial planning tool. Depending on the type of policy you choose, it can offer investment opportunities and cash value accumulation over time. This cash value can be accessed or borrowed against if you need funds for emergencies, major expenses, or even as a supplement to your retirement income. It provides flexibility and the potential for growth, making it a valuable asset to consider in your long-term financial planning strategy.

In conclusion, life insurance is a crucial component of safeguarding your family’s future. It provides financial protection, stability, and investment opportunities all in one package. By securing a life insurance policy, you can have peace of mind knowing that your loved ones will be taken care of and have the financial resources they need when faced with unexpected circumstances.