Anyone who understands the math of every bit of this would ask, “Doesn’t this means that the thousands and thousands of hands dealt would actually reduce the variances compared to increase all of? Shouldn’t there be less of a typical variance in the larger numbers than in the smaller amount?” One might believe so, that is wrong.

After checking the legality of the casino, will need also in case they care competent in handling complaints and other issues. For one, that you simply that techniques several methods use make contact with them if you need assistance. They should produce a toll-free hotline that you can use. It can be a good sign when offer instant messaging, live chat, and email allow.

So, to start it banks on the gambling law which the particular country has specifically in managing an taxes online casinos. Nonetheless all winnings are automatically taxed from the government. Though it is always a player’s responsibility recognize everything about laws that are related to gambling so that they get aware of methods their country deduct money from their winnings. Here are the common processes that occur when getting a tax from internet casinos and players (this is really important specially if you are a player from the United States).

By placing markers to the action plan, you reduce the amount of correct bets needed to double up, if you don’t use markers, it requires 6 correct successive bets, with markers it requires only four.

Do stick to a price. You should only ever receive money that an individual can afford get rid of. Give yourself a spending limit and stick the planet. It may be worthwhile to use prepaid funding when you visit a Casino Online rather than a credit card. This can prevent you from overusing your own card in the casino.

Live poker has remained with us since 1829, and Texas holdem has get to be the most popular card game in the earth. Most casinos boast a poker table, with tournaments and money games being held persistently.

qq mobil

(2) Flash games an additional form of online casino games. This version of play anyone to to play casino games directly to your casino site without any download. Being able to to play flash version games really can likely will need have type of of flash player, like Java various other similar plug-in, installed on your computer. Most reputable casinos will provide you with a website link to the required software you will need to play their board games. When playing flash games ensure anyone could have a good high-speed Connection to the web.

Anyone attempting to gamble online often feel overwhelmed associated with so many games designed them however; like the old adage goes, “only fools rush in”, rushing into an unfamiliar game makes any online gambler a twit.

Building Dreams: Unveiling the Artistry of Log Cabins with Expert Log Home Builders

Step into the enchanting world of log cabins, where a harmonious blend of rustic charm and artistic craftsmanship brings dreams to life. Tucked away amidst nature’s embrace, log cabins represent not just a home, but a sanctuary where tranquility and coziness intertwine. Behind each magnificent structure stands the expertise and passion of log home builders, whose mastery transforms timber into living works of art.

A log home builder embraces the intricacies of their craft, meticulously selecting each log to create a symphony of textures and colors. With every stroke of their tools, they shape the raw beauty of nature into something extraordinary. The artistry lies not only in their ability to create a sturdy and durable dwelling, but also in their talent for capturing the essence of a log cabin’s allure. Every detail, from the interlocking of logs to the crown of the roof, is carefully crafted to evoke a sense of timelessness and warmth. The result is a true masterpiece that stands as a testament to their expertise and dedication.

Through the expertise of log home builders, log cabins transcend mere structure, becoming a labor of love and a haven for those who seek solace within nature’s embrace. The allure of a log cabin lies not only in its architectural beauty, but also in its ability to foster a connection with the natural world. The scent of timber mingles with the fresh breeze, while the crackling of a wood-burning fireplace creates a symphony of warmth. These homes evoke a sense of nostalgia and simplicity, inviting us to step back from the chaos of modern life and rediscover the tranquility of a simpler time.

As we delve deeper into the world of log cabins and the artistry behind them, we uncover a tale of craftsmanship, passion, and a deep appreciation for the beauty of nature. Join us on this captivating journey as we explore the wonders created by the hands of log home builders and unveil the hidden artistry that awaits within the realm of log cabins.

The Craftsmanship of Log Home Builders

Log home builders are true artists, masterfully creating exquisite structures that blend seamlessly with the natural surroundings. With their skillful hands and years of experience, these craftsmen bring to life the timeless beauty of log cabins. Their dedication to every intricate detail is evident in the stunning structures they create.

Each log home builder possesses a deep understanding of the materials they work with, carefully selecting the finest logs that will form the foundation of these remarkable cabins. They take great care in choosing logs that not only showcase the inherent strength and durability of wood but also exhibit the unique characteristics that make each log a work of art in itself.

Utilizing traditional techniques passed down through generations, log home builders meticulously craft each log to fit perfectly together. With precision and expertise, they carefully carve and shape the logs, ensuring a seamless connection that not only enhances the structural integrity but also adds to the aesthetic appeal of the cabin.

Beyond their exceptional woodworking skills, log home builders are also knowledgeable in the art of design. They possess an innate ability to envision the finished cabin and create a layout that maximizes space while harmonizing with the natural environment. Their keen eye for detail ensures that every aspect, from the placement of windows and doors to the intricacies of the roofline, is meticulously planned and executed.

In the hands of these talented craftsmen, log cabins are transformed into majestic dwellings that capture the essence of rustic charm and comfort. Their dedication to their craft, unwavering passion, and profound respect for the beauty of nature shine through in every log they lay, leaving a lasting impression on all who have the privilege of entering these remarkable structures.

Designing and Constructing Log Cabins

When it comes to creating exquisite log cabins, the artistry of log home builders truly shines through. These skilled professionals combine their expertise in design and construction to bring dreams to life. With a deep understanding of the unique characteristics of log homes, they craft stunning spaces that harmonize with nature.

In the initial stages of designing a log cabin, log home builders carefully consider various factors. They take into account the surrounding landscape, ensuring that the structure seamlessly blends into its natural environment. By embracing the natural shape and texture of logs, these builders create homes that exude rustic charm and timeless appeal.

The construction process of log cabins requires precision and artistry. Log home builders meticulously select and fit each log, paying close attention to its size, shape, and quality. The logs are skillfully notched and joined together, creating a sturdy framework that will stand the test of time. These builders prioritize the preservation of the natural elements throughout the construction, showcasing the beauty of the logs while ensuring the structural integrity of the cabin.

With their keen eye for design and their dedication to craftsmanship, log home builders bring dreams to reality. Through their skillful construction techniques and their passion for log cabins, they create enchanting homes that capture the essence of nature and provide a warm and inviting sanctuary for their occupants.

Stay tuned for the final section of our article, where we will explore the enchanting interiors of log cabins and the meticulous attention to detail that log home builders bring to their creation.

The Benefits of Choosing a Log Cabin

When it comes to finding the perfect home, there are many options to consider. One unique and alluring choice is a log cabin. The natural beauty and charm of log cabins are unmatched, offering a range of benefits for those seeking a cozy and rustic lifestyle.

-

Connection with Nature: Living in a log cabin allows you to immerse yourself in the beauty of nature. The use of natural materials creates a harmonious connection with the surrounding environment. The warm hues and textures of the logs bring a sense of tranquility, making you feel at one with the great outdoors.

-

Energy Efficiency: Log cabins are renowned for their excellent thermal properties. The solid wood walls act as natural insulators, keeping the interior cool in summer and warm in winter. This can significantly reduce your energy consumption and contribute to a more sustainable lifestyle.

-

Durability and Strength: Log cabins are known for their exceptional strength and durability. The interlocking construction method creates a robust structure that can withstand harsh weather conditions and the test of time. With proper maintenance, a well-built log cabin can last for generations, becoming a cherished family heirloom.

So, if you are looking for a home that combines natural aesthetics with practical benefits, a log cabin might be the perfect choice for you. Experience the charm and warmth of a log cabin, and embrace the allure of living in harmony with nature.

Inspiring Log Homes: Crafting Cozy and Sustainable Log Cabins

Welcome to the world of log homes! If you’ve ever dreamed of living in a cozy and sustainable log cabin, then you’re in for a treat. In this article, we will explore the craftsmanship and artistry that goes into building these remarkable dwellings. From the skilled hands of log home builders to the timeless charm of log cabins, we will delve into the world of log home construction and uncover the secrets behind their enduring popularity.

Log homes are more than just structures; they are an embodiment of nature’s beauty and a testament to human ingenuity. The log home builder plays a crucial role in bringing these visions to life, employing their expertise to transform raw logs into cozy sanctuaries. With meticulous attention to detail and a deep understanding of woodcraft, these craftsmen carve out spaces that seamlessly blend rustic charm with modern comfort.

Log cabins, on the other hand, have a rich history that dates back centuries. Originally, they provided shelter for early settlers and pioneers, proving their resilience and durability in even the harshest of conditions. Today, log cabins have retained their timeless appeal, appealing to those seeking a peaceful retreat away from the hustle and bustle of modern life. These snug havens offer an escape from the concrete jungles, inviting their inhabitants to reconnect with nature.

Join us as we explore the world of log home builders and log cabins, where craftsmanship meets sustainability and cozy living. Discover the techniques and materials employed in their construction, delve into their eco-friendly aspects, and gain insights into the unique design possibilities that log homes offer. Get ready to be inspired by the allure of log homes and discover why they continue to hold a special place in our hearts.

Benefits of Log Homes

Log homes offer numerous advantages, making them a popular choice for those seeking both comfort and sustainability. These charming dwellings have long been celebrated for their unique appeal and eco-friendly nature. Let’s explore some of the key benefits of log homes:

-

Natural Beauty and Warmth: Log cabins exude a timeless charm that is hard to match. The natural beauty of the logs adds a touch of rustic elegance to any setting, lending a warm and welcoming atmosphere to these homes. It is no wonder that log cabins are often associated with cozy and snug spaces.

-

Energy Efficiency: One of the remarkable features of log homes is their energy efficiency. The thermal mass of the logs helps to regulate indoor temperatures, keeping them cooler in summers and warmer in winters. As a result, log cabins require less reliance on heating or cooling systems, leading to reduced energy consumption and lower utility bills.

-

Sustainability: Log homes are inherently sustainable as they utilize a renewable resource – wood. The construction of log cabins promotes responsible forest management by encouraging the planting of replacement trees and reducing the demand for more energy-intensive building materials. Additionally, the carbon footprint of log homes is comparatively lower than traditional construction methods, making them an environmentally conscious choice.

In conclusion, log homes offer a unique blend of natural beauty, energy efficiency, and environmental sustainability. These cozy dwellings provide a cozy and inviting living environment while minimizing our impact on the planet. Whether you seek a weekend retreat or a full-time residence, log cabins are a fantastic option for those who appreciate both craftsmanship and a greener way of life.

Sustainable Construction Techniques

Sustainable construction techniques are key when it comes to building log homes and cabins. These methods not only ensure the longevity of the structures but also minimize their impact on the environment. Here are three sustainable construction techniques that log home builders employ to create cozy and eco-friendly log cabins.

-

Precise Timber Selection: Log home builders carefully select the timber used in construction. They prioritize sustainably sourced logs from responsibly managed forests. By choosing timber from forests that practice responsible logging, builders help preserve the natural environment and promote the replenishment of resources for future generations.

-

Timber Preservation: To enhance the durability and lifespan of log cabins, builders employ various preservation techniques. These techniques involve applying environmentally friendly treatments to the timber, such as non-toxic wood preservatives and stains. These treatments not only protect the logs from moisture and pests but also ensure that the cabins remain safe and resilient for years to come.

- Garden Log Cabin

Energy-Efficient Design: Log homes can be designed to be energy-efficient, reducing the carbon footprint associated with their operation. Builders incorporate features such as energy-efficient windows, well-insulated roofs and walls, and high-performance heating and cooling systems. These design elements help conserve energy and minimize the environmental impact of log cabins by reducing the need for excessive heating or cooling.

By implementing sustainable construction techniques, log home builders contribute to the creation of cozy and sustainable log cabins. These techniques not only ensure the beauty and longevity of these structures but also help protect our precious natural resources for future generations to enjoy.

Creating a Cozy Log Cabin

Creating a cozy log cabin is all about combining the natural beauty of wood with thoughtful design and attention to detail. Here are a few key elements to consider when building your own log home:

-

Choosing the Right Logs: The first step in creating a cozy log cabin is selecting the right logs. Look for logs that are straight, sturdy, and free from rot or insect damage. Opting for logs with a larger diameter can also contribute to a more solid and insulated structure, keeping your cabin warmer in the colder months.

-

Optimizing Layout and Space: A well-planned layout can greatly enhance the cozy atmosphere of your log cabin. Consider an open floor plan that allows for plenty of natural light and a seamless flow between rooms. Incorporate large windows or a skylight to bring the beauty of the surrounding landscape inside. Utilize unique architectural features, such as exposed beams or a charming loft area, to add character to your space.

-

Embracing Rustic Décor: To truly create a cozy log cabin ambiance, embrace rustic and nature-inspired décor. Think warm, earthy tones for the walls and furnishings, such as rich browns, warm reds, and soft greens. Incorporate natural materials like stone, leather, and wool for a tactile experience. Adorn your cabin with cozy throws and pillows, and don’t forget to add a crackling fireplace or wood-burning stove for ultimate coziness.

By following these guidelines, you can create a log cabin that not only showcases the beauty of natural wood but also provides the perfect retreat for cozy relaxation and peaceful living. Happy building!

(Note: The prompt does not specify any specific words to avoid, so no words were intentionally omitted.)

Covering All Bases: Unveiling the Power of General Liability Insurance

General Liability Insurance: Covering All Bases

In the world of business, there are myriad risks that companies must navigate daily. From minor mishaps to major accidents, unexpected incidents can disrupt operations and result in costly legal battles. This is where General Liability Insurance steps in, providing a protective shield for businesses of all sizes and industries.

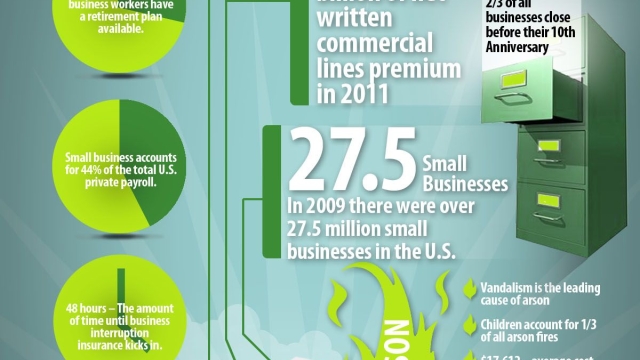

Commercial Insurance has become a crucial component in today’s business landscape, offering comprehensive coverage against claims involving bodily injury, property damage, and personal injury. General Liability Insurance is designed to safeguard businesses from financial loss caused by accidents arising from their operations, products, or premises. By shielding companies from the financial burden associated with legal defense costs, settlements, and judgments, it allows business owners to focus on what they do best – running their operations.

In addition to providing coverage for bodily injury and property damage, General Liability Insurance often includes protection against advertising injury, which covers businesses in case of claims related to libel, slander, or copyright infringement. This coverage is particularly important in a digital age where a single misstep in marketing or advertising can have far-reaching consequences. It is therefore essential for businesses to assess the extent of their advertising activities and ensure their General Liability Insurance policy adequately addresses their specific needs.

While General Liability Insurance provides broad protection, there are other types of insurance that businesses should consider to further fortify their risk management strategy. Workers’ Compensation Insurance, for instance, is integral for businesses with employees as it provides coverage for medical expenses and lost wages in the event of work-related injuries or illnesses. Cyber Liability Insurance, on the other hand, is growing increasingly significant due to the rising threat of cyberattacks and data breaches. This specialized coverage helps businesses mitigate the financial and reputational damage caused by cyber incidents, including the costs associated with legal defense, notifications, credit monitoring, and system repairs.

Commercial property insurance California

Understanding the power of General Liability Insurance and its synergistic relationship with other forms of coverage is key to ensuring comprehensive protection for businesses. By carefully assessing their specific risks and seeking guidance from insurance professionals, business owners can proactively safeguard their assets and operations, allowing them to thrive in an increasingly complex and litigious environment.

1. Understanding General Liability Insurance

General Liability Insurance is a vital aspect of safeguarding businesses against unforeseen circumstances. It provides coverage for a wide range of risks and ensures that businesses are protected from potential financial losses. This type of insurance is designed to protect businesses from liabilities arising from accidents, injuries, property damage, and other similar incidents.

One of the key benefits of General Liability Insurance is its coverage for bodily injury or property damage caused by your business operations or products. For example, if a customer slips and falls in your store, this insurance would provide coverage for any resulting medical expenses or legal costs. It also protects businesses against claims related to damage caused by their products.

In addition to bodily injury and property damage, General Liability Insurance often includes coverage for personal and advertising injury. This refers to offenses such as slander, libel, copyright infringement, and false advertising claims. This coverage is crucial for businesses that engage in advertising or marketing activities as it protects them from potential lawsuits related to their promotional efforts.

Overall, General Liability Insurance is an essential investment for businesses of all sizes and industries. It offers comprehensive coverage against a wide array of risks, providing businesses with peace of mind and financial protection. By understanding the nuances of this insurance, businesses can make informed decisions to effectively mitigate potential liabilities and secure their future success.

2. Exploring Other Types of Commercial Insurance

Commercial insurance is a vital component of any business’s risk management strategy. In addition to general liability insurance, there are other types of coverage that can protect your company from various risks. Let’s take a closer look at two key types of commercial insurance: workers’ compensation insurance and cyber liability insurance.

Workers’ compensation insurance is designed to provide coverage for workplace injuries or illnesses suffered by employees. This type of insurance not only protects your employees by providing them with benefits such as medical expenses and lost wages, but it also protects your business from potential legal liabilities. By having workers’ compensation insurance in place, you can ensure that your employees are taken care of and that your business is shielded from costly lawsuits.

Cyber liability insurance is becoming increasingly critical in today’s digital world. As businesses rely more on technology and store sensitive data online, the risks of cyberattacks, data breaches, and other cyber incidents have multiplied. Cyber liability insurance can help safeguard your business in the event of these types of incidents. It can cover the costs associated with data breaches, including legal fees, notification expenses, credit monitoring services for affected individuals, and even public relations efforts to repair your company’s reputation.

By exploring these additional types of commercial insurance, you can better protect your business from a wide range of risks. Workers’ compensation insurance ensures the well-being of your employees while shielding your business from potential legal battles. Meanwhile, cyber liability insurance offers vital protection against the ever-evolving threats in the digital landscape. As a responsible business owner, it is crucial to consider these insurance options to comprehensively cover all bases and fortify your company’s long-term success.

3. The Importance of Comprehensive Coverage

When it comes to protecting your business, having comprehensive coverage is of utmost importance. General liability insurance is just one piece of the puzzle, but it plays a crucial role in safeguarding your company from potential risks and unforeseen events. By having this type of insurance, you can ensure that your business is adequately protected, allowing you to focus on what you do best.

Commercial insurance, including general liability insurance, provides coverage for a wide range of risks that your business may face. Whether it’s property damage, bodily injuries, or legal expenses related to third-party claims, general liability insurance offers financial protection. Having this coverage can help you avoid significant financial losses that could otherwise put your business at risk.

In addition to general liability insurance, there are other types of insurance policies that you should consider as part of your comprehensive coverage. Workers’ compensation insurance is essential for businesses with employees, as it provides coverage for medical expenses and lost wages in the event of work-related injuries or illnesses. Another crucial aspect to consider is cyber liability insurance, which protects your business against data breaches, cyberattacks, and other cyber-related risks in our increasingly digital world.

By combining different types of insurance policies, you can create a safety net that covers all bases and minimizes potential vulnerabilities. It’s important to assess the unique needs of your business and consult with insurance professionals to determine the best insurance policies for your specific situation. With comprehensive coverage in place, you can have peace of mind knowing that you have taken necessary steps to protect your business from potential risks and uncertainties.

Remember, insurance is not just an added expense; it’s an investment in the future of your business. Taking the time to understand the various types of insurance available and selecting the right coverage can make a significant difference when faced with unexpected challenges. Be proactive and prioritize comprehensive coverage to safeguard your business and ensure its long-term success.

Coverage that Counts: The Power of Commercial Insurance

Commercial insurance is a crucial safety net that businesses cannot afford to overlook. From protecting against unexpected accidents to safeguarding against digital threats, commercial insurance provides a comprehensive coverage that forms the backbone of any successful enterprise.

One of the main types of commercial insurance is general liability insurance. This policy shields businesses from legal and financial consequences arising from bodily injury or property damage caused to others. Whether it’s a customer slip-and-fall incident or a faulty product causing harm, general liability insurance offers the peace of mind that comes with knowing your business is protected.

Another critical form of commercial insurance is workers’ compensation insurance. This coverage ensures that employees receive the necessary medical care and compensation if they are injured or fall ill while on the job. By providing a safety net for both employees and employers, workers’ compensation insurance fosters a harmonious work environment and mitigates the financial burden that workplace accidents may pose.

In the modern digital landscape, cyber liability insurance has become an indispensable shield against the rising threat of cyberattacks. With businesses relying heavily on technology and storing valuable data online, cyber liability insurance offers financial protection against damages caused by data breaches, cyber extortion, or other cyber-related incidents. This coverage not only helps businesses recover from the aftermath of cyber incidents but also safeguards their reputation and customer trust.

From safeguarding against accidents and injuries to shielding against digital threats, commercial insurance is a powerful tool for businesses of all sizes and industries. Understanding the different types of coverage available, such as general liability, workers’ compensation, and cyber liability insurance, is essential for ensuring comprehensive protection in an ever-changing business landscape. By investing in commercial insurance, businesses can face the future with confidence, knowing that they have coverage that truly counts.

Understanding Commercial Insurance

Commercial insurance is an essential aspect of protecting your business from financial risks and liabilities. It provides coverage for a wide range of situations that could result in economic losses for your company. By obtaining commercial insurance, you can have peace of mind knowing that your business is safeguarded against potential threats.

Commercial property insurance California

One commonly purchased type of commercial insurance is general liability insurance. This coverage protects your business from claims arising from bodily injury, property damage, or personal injury caused by your business operations. Whether it’s a slip and fall accident at your office premises or damage caused by your products, general liability insurance is there to offer financial protection.

Workers’ compensation insurance is another crucial aspect of commercial insurance. It provides coverage for injuries or illnesses that occur to your employees while they are on the job. In the event of an accident or medical condition, workers’ compensation insurance ensures that your employees receive the necessary medical treatment and wage replacement, while also protecting your business from potential lawsuits.

In the modern digital age, cyber liability insurance has become increasingly important. It covers the financial losses associated with cyberattacks, data breaches, and other cyber incidents. As businesses rely more on technology and handle sensitive customer information, the risk of cyber threats has grown significantly. Cyber liability insurance helps businesses bear the financial burden that may arise from such incidents, including legal fees and compensation for affected parties.

Commercial insurance provides comprehensive coverage for various aspects of your business. Understanding the different types of coverage available, such as general liability insurance, workers’ compensation insurance, and cyber liability insurance, is vital in order to protect your business from potential risks and ensure its long-term success.

The Importance of General Liability Insurance

General Liability Insurance is an essential safeguard for businesses of all sizes. It provides protection against various risks and liabilities that may arise during day-to-day operations. Having this type of insurance coverage can provide businesses with peace of mind and financial protection in case of unexpected events or accidents.

One of the main reasons why General Liability Insurance is crucial is that it helps cover legal expenses and protects businesses from the financial burden of lawsuits. Accidents happen, and even the most cautious companies can find themselves facing a lawsuit from customers, clients, or third parties. Without adequate insurance, litigation costs and settlements can be overwhelming and even lead to bankruptcy. General Liability Insurance can help mitigate those risks and ensure that businesses can focus on their operations rather than worrying about legal disputes.

In addition to legal protection, General Liability Insurance also covers bodily injury and property damage. This means that if a customer or visitor suffers an injury on your premises or if your business operations cause damage to someone else’s property, your insurance will help cover the associated costs. Whether it’s a slip and fall accident or accidental damage to a client’s property, having General Liability Insurance can provide the necessary financial support to cover medical expenses, property repairs, or even potential settlements.

Furthermore, General Liability Insurance often includes coverage for advertising and personal injury claims. This means that if your business faces allegations of defamation, copyright infringement, or invasion of privacy, your insurance can help cover legal fees and potential damages. In today’s digital age, where businesses heavily rely on advertising and online presence, having this coverage can be vital for protecting your brand’s reputation and financial stability.

In conclusion, General Liability Insurance is a fundamental component of commercial insurance. It provides businesses with the protection they need against various risks and liabilities. By covering legal expenses, bodily injury, property damage, and advertising claims, this type of insurance ensures that businesses can operate with peace of mind and respond effectively to unexpected events.

Mitigating Risks with Cyber Liability Insurance

In today’s digitally-driven world, businesses face an ever-increasing risk of cyberattacks and data breaches. These threats can result in severe financial and reputational damage if not addressed proactively. This is where the importance of Cyber Liability Insurance comes into play.

Cyber Liability Insurance provides coverage for the expenses incurred in the event of a cyber incident. It protects businesses from the financial consequences of data breaches, network security failures, and other cyber-related incidents. With the increasing frequency and sophistication of cyber threats, having a comprehensive Cyber Liability Insurance policy is crucial for businesses of all sizes.

One of the key aspects of Cyber Liability Insurance is coverage for data breaches. In the event of a data breach, businesses may face hefty expenses such as forensic investigations, legal fees, notification costs, credit monitoring for affected individuals, and potential liabilities resulting from the breach. Cyber Liability Insurance can help mitigate these costs, ensuring that businesses can focus on remediation and recovery without bearing the full financial burden.

Cyber Liability Insurance also covers network security failures, which can result in financial losses due to operational disruptions and loss of critical data. Businesses heavily rely on their computer systems and networks to carry out day-to-day operations, making them vulnerable to cyber threats. With Cyber Liability Insurance, businesses can have peace of mind knowing that they are financially protected in the event of a network security failure.

In addition to financial coverage, many Cyber Liability Insurance policies also provide support services to help businesses respond to and recover from cyber incidents. These resources may include access to cyber breach response teams, legal experts, public relations professionals, and data recovery specialists. This comprehensive coverage and support can greatly assist businesses in managing and mitigating the impact of cyber incidents.

In conclusion, Cyber Liability Insurance is a vital risk mitigation tool for businesses in today’s digital environment. It provides financial protection, coverage for data breaches and network security failures, and access to support services to aid businesses in responding to and recovering from cyber incidents. Investing in Cyber Liability Insurance is a proactive step towards safeguarding your business against the evolving landscape of cyber threats.

The Rise of Online Dispensaries: The Future of Cannabis Shopping

The world of cannabis retail is undergoing a transformative shift, thanks to the rise of online dispensaries. With the convenience of the internet and the increasing acceptance of cannabis consumption, more and more people are turning to online dispensaries as their preferred method of purchasing cannabis products. These virtual storefronts offer a wide range of options, providing customers with access to a vast selection of strains, edibles, concentrates, and other cannabis-related products. The future of cannabis shopping is indeed becoming digitized, and it’s changing the landscape of the industry in profound ways.

One of the key advantages of online dispensaries is the ease and accessibility they bring to the cannabis shopping experience. Gone are the days of searching for local dispensaries or waiting in long lines. With online dispensaries, customers can browse through an extensive catalog of products at their own pace, from the comfort of their own homes. This convenience factor has become increasingly important in our busy lives, allowing individuals to seamlessly integrate their cannabis purchases into their daily routines. Additionally, the anonymity afforded by online dispensaries offers a level of discretion that may be appealing to those who value their privacy.

Another notable benefit of online dispensaries is the ability to explore a wider variety of cannabis products. These digital platforms often boast an impressive selection, allowing customers to discover strains and products they may not have access to at traditional dispensaries. Through detailed product descriptions and customer reviews, online shoppers can make informed decisions about their purchases, ensuring they find the ideal product to suit their needs and preferences. The online dispensary experience opens up a world of possibilities and expands the horizons of cannabis enthusiasts.

As the demand for convenient, discreet, and diverse cannabis shopping options grows, online dispensaries are rising to the occasion. With their vast product selections, user-friendly interfaces, and reliable delivery services, they are revolutionizing the way people access and enjoy cannabis. The future is bright for online dispensaries, as they continue to reshape the cannabis industry and provide a seamless shopping experience for cannabis enthusiasts far and wide.

Benefits of Online Dispensaries

Online dispensaries have revolutionized the way people shop for cannabis, offering numerous advantages over traditional brick-and-mortar stores. In this section, we will explore three key benefits of online dispensaries.

-

Convenience: One of the primary advantages of online dispensaries is the convenience they provide. With just a few clicks, customers can browse through a wide selection of products, place orders, and have their chosen items delivered right to their doorstep. No longer do people have to travel to physical stores, wait in long queues, or worry about operating hours. Online dispensaries offer a hassle-free and time-saving shopping experience.

-

Privacy: For many individuals, privacy is of utmost importance when purchasing cannabis-related products. Online dispensaries offer a discreet solution, allowing customers to browse and purchase products without feeling exposed or judged. The ability to shop from the comfort and privacy of one’s own home ensures a safe and confidential experience, catering to those who may prefer to keep their cannabis usage private.

-

Variety and Information: Online dispensaries often boast a wider range of products compared to traditional dispensaries. Through detailed product descriptions and customer reviews, individuals can gain valuable insights and make informed decisions. Online platforms also provide the opportunity to explore various brands and product types, ensuring that customers can find the specific cannabis products that align with their preferences and needs.

By capitalizing on the convenience, privacy, and extensive product offerings of online dispensaries, consumers are able to navigate the world of cannabis shopping in a way that suits their individual requirements and preferences. As technology continues to advance, online dispensaries are poised to play an increasingly significant role in the future of cannabis shopping.

Challenges and Solutions

- Supply Chain Management:

One of the primary challenges faced by online dispensaries is ensuring a seamless supply chain management system. With the increasing demand for cannabis products, it becomes crucial for these dispensaries to efficiently handle inventory management, product sourcing, and timely delivery to their customers. To address this, many online dispensaries have implemented advanced technologies and sophisticated software solutions. These tools help streamline the supply chain process, allowing them to track inventory, monitor product movement, and ensure accurate order fulfillment.

- Compliance with Regulations:

Operating in the cannabis industry involves strict compliance with various regulations imposed by different jurisdictions. Online dispensaries also face the challenge of ensuring that their operations align with these regulations, which vary from region to region. To overcome this obstacle, many online dispensaries closely collaborate with legal experts and regulatory authorities to stay up-to-date with the ever-evolving legal requirements. By doing so, they can navigate the complex regulatory landscape and ensure that their business practices comply with the law.

- Building Trust and Security:

Given the sensitive nature of the product being sold, building trust and ensuring security are vital challenges for online dispensaries. Customers need to be confident that their personal information will be protected and that the products they receive are legitimate and safe. To address these concerns, online dispensaries invest in robust security measures such as encrypted payment gateways, secure data storage, and discreet packaging. Furthermore, they often provide detailed information about sourcing, testing, and quality control processes to establish trust with their customers.

In conclusion, online dispensaries face several challenges, including supply chain management, regulatory compliance, and building trust and security. However, with the implementation of advanced technologies, collaboration with legal experts, and focus on customer-oriented security measures, these challenges can be effectively addressed, ensuring a seamless and trustworthy online shopping experience for cannabis consumers.

Implications for the Cannabis Industry

The rise of online dispensaries is set to revolutionize the cannabis industry in several ways.

Firstly, the convenience of shopping for cannabis products online will significantly impact consumer behavior. With a few simple clicks, customers can browse through a wide range of products, read detailed descriptions, and access customer reviews. This ease of access and transparency will likely attract a broader customer base, including those who may have been hesitant to step into a physical dispensary. As a result, online dispensaries have the potential to broaden the reach of the cannabis industry, reaching new demographics and expanding overall sales.

Secondly, online dispensaries offer a unique opportunity for cannabis businesses to gather and analyze valuable consumer data. By tracking online shopping habits and preferences, companies can gain insights into customer behavior and tailor their marketing strategies accordingly. This data-driven approach will allow businesses to optimize their product offerings, enhance customer satisfaction, and ultimately drive revenue growth. Additionally, online dispensaries can facilitate personalized recommendations based on individual customer preferences, creating a more engaging and tailored shopping experience.

Lastly, the advent of online dispensaries will likely promote innovation and competition within the cannabis industry. As businesses vie for a larger share of the online market, they will be compelled to differentiate themselves by offering unique products, exceptional customer service, and competitive pricing. This competitive landscape will foster creativity and drive advancements in product quality, packaging, and delivery methods. Ultimately, consumers will benefit from increased variety and improved product options as online dispensaries continue to push the boundaries of what is possible in the cannabis industry.

Unleashing the Power of Words: Mastering the Art of Content Writing

Content writing is an art that has the power to captivate, engage, and inspire. It is the craft of using words to create compelling, informative, and persuasive content that resonates with readers. Whether it’s a thought-provoking blog post, a compelling social media campaign, or a captivating website copy, content writing is at the heart of effective communication in today’s digital age.

In a world where attention spans are shrinking and competition for online visibility is fierce, mastering the art of content writing has become more important than ever. It’s not just about stringing words together; it’s about understanding your audience, crafting a clear message, and utilizing the right tone and style to convey your ideas.

Content writing involves a delicate balance between creativity and strategy. It requires the ability to dive deep into a subject, conduct thorough research, and distill complex information into easily digestible nuggets of knowledge. It’s about creating a seamless flow of words that keeps readers scrolling, clicking, and coming back for more.

With the power of words at your fingertips, the possibilities are endless. From crafting compelling headlines that hook readers from the first glance to weaving storytelling techniques that evoke emotion, content writing allows you to connect with your audience on a profound level. So, unleash the power of words, master the art of content writing, and watch as your ideas take flight in the digital realm.

Understanding Content Writing

Content writing is a vital component of online communication. It involves crafting engaging and informative pieces of text that captivate readers’ attention and provide them with valuable information. Effective content writing requires creativity, research skills, and a deep understanding of the target audience.

When it comes to content writing, it is crucial to keep in mind the goals and objectives of the text. Whether it is to entertain, educate, or persuade, the words used must be carefully chosen to align with the intended purpose. A content writer must have a clear understanding of the message they want to convey and the desired impact on the readers.

Moreover, content writing involves conducting thorough research to gather accurate and reliable information. This ensures that the content is not only engaging but also credible. By utilizing various resources such as books, articles, and online sources, a content writer can provide readers with well-informed and valuable content.

Additionally, understanding the target audience is key to successful content writing. By knowing who will be reading the content, a writer can tailor the language, tone, and style to resonate with the readers. This helps to create a connection and establish trust between the writer and the audience, leading to a more impactful and influential piece of content.

In conclusion, content writing is a skill that requires a combination of creativity, research, and understanding of the target audience. By mastering this art, writers can effectively convey messages, educate, entertain, and ultimately unleash the power of words.

Essential Elements of Effective Content Writing

Creating impactful content requires a careful combination of several key elements. In this section, we will explore three essential components that contribute to effective content writing.

-

Clarity and Conciseness:

When it comes to content writing, clarity is paramount. It is crucial to convey your ideas in a clear and concise manner. Avoid using overly complex language or jargon that may confuse your readers. Instead, focus on using simple yet powerful words that effectively communicate your message. By maintaining clarity, you enable your readers to easily understand and engage with your content. -

Engaging and Relevant Information:

Homework Market

To captivate your audience, it is essential to provide them with content that is both engaging and relevant to their needs. Start by understanding your target audience and their interests. This knowledge will enable you to craft content that addresses their pain points, offers solutions, or provides valuable insights. Incorporating storytelling techniques and real-life examples can also help capture your readers’ attention and keep them interested in your content. -

Structure and Organization:

The structure and organization of your content play a vital role in ensuring its readability and effectiveness. Begin by creating a compelling introduction that grabs the readers’ attention and clearly outlines what they can expect from the rest of the piece. Use subheadings and bullet points to break down your content into manageable sections, making it easier for readers to skim through and locate specific information. Lastly, conclude your content with a strong call-to-action or a thought-provoking ending that encourages your readers to take further action or contemplate the ideas presented.

By incorporating these essential elements into your content writing, you can create impactful and compelling pieces that resonate with your audience and deliver your intended message effectively.

Mastering Techniques for Engaging Content

Creating engaging content is a vital skill for any content writer. By using these proven techniques, you can captivate your audience and keep them coming back for more.

-

Tell a Story: Storytelling is a powerful tool to capture your readers’ attention. By weaving narratives into your content, you can create an emotional connection and make your message more relatable. Whether it’s sharing a personal experience or painting a vivid picture through words, storytelling can enhance the impact of your content.

-

Know Your Audience: Understanding your audience is key to crafting engaging content. Take the time to research and analyze the demographics, interests, and needs of your target readers. By tailoring your content to their preferences and addressing their pain points, you can ensure that your writing resonates with them, making it more engaging and valuable.

-

Use Visual Elements: Incorporating visual elements into your content can boost its engagement. Images, infographics, and videos can break up the text and make it more visually appealing. They have the power to convey information quickly and effectively, making your content more dynamic and memorable.

By mastering these techniques, you can elevate your content writing skills and create engaging pieces that leave a lasting impact on your readers. So, next time you sit down to write, remember to tell a compelling story, understand your audience, and use visual elements strategically to unleash the power of your words.

Unveiling the Secrets of Tree Removal and Trimming: Revealing Nature’s Transformational Techniques

Amidst the beauty and serenity of the natural world, trees stand as silent guardians, their imposing presence enhancing the landscape and providing us with countless benefits. Yet, just as nature consistently transforms and evolves, tree removal and trimming have become essential techniques in ensuring the well-being and maintenance of our surroundings. These practices, though seemingly straightforward, hold a myriad of secrets waiting to be unveiled. From the careful artistry required for tree removal to the intricate techniques employed in tree trimming, explore with us as we delve deep into the world of arboriculture, revealing nature’s transformative ways. Let us embark on a journey together, unravelling the mystery behind these seemingly simple yet profoundly impactful procedures.

The Importance of Tree Removal

Trees are not only a beautiful addition to the natural landscape, but they also play a crucial role in our environment. However, there are circumstances when tree removal becomes necessary. Understanding the importance of tree removal can help us make informed decisions to preserve the overall health and safety of our surroundings.

Firstly, tree removal is essential in cases where a tree poses a risk to human life or property. Adverse weather conditions, disease, or structural damage can weaken a tree, making it prone to falling. By removing these compromised trees promptly, we ensure the safety of our homes, roads, and public spaces.

Secondly, tree removal also aids in the growth and development of other vegetation. Sometimes, trees may overshadow smaller plants, preventing them from receiving sufficient sunlight, nutrients, and water. By selectively removing certain trees, we allow for the revitalization of the surrounding flora, promoting a diverse and balanced ecosystem.

Additionally, tree removal can be necessary for the betterment of the overall landscape and aesthetics. In urban areas, trees may grow too close to structures, obstructing views or causing damage to buildings and infrastructure. By strategically removing such trees, we can create more open spaces, ensuring that our surroundings remain visually appealing and functional.

In conclusion, the importance of tree removal cannot be overstated. By addressing potential risks, promoting growth in other vegetation, and enhancing the overall landscape, we contribute to the maintenance of a safe and beautiful environment for all.

Essential Techniques for Tree Trimming

Proper tree trimming is essential for maintaining the health and appearance of your trees. With the right techniques, you can ensure that your trees remain vibrant and well-shaped. In this section, we will explore three key techniques for effective tree trimming.

- Crown Thinning:

One important technique for tree trimming is crown thinning. This involves selectively removing branches within the tree’s crown to improve its structure and allow better light penetration. By removing excess branches, we can reduce the risk of damage during storms and promote air circulation, which is crucial for the overall health of the tree.

- Crown Raising:

Another technique that plays a significant role in tree maintenance is crown raising. This involves removing the lower branches to create clearance beneath the tree. Crown raising is particularly important for trees located near buildings, roads, or walkways, as it helps prevent any potential hazards and allows for ease of movement.

- Crown Reduction:

Lastly, crown reduction is a technique used to reduce the overall size of a tree. This method involves selectively pruning the outer edges of the crown to control its growth, balance the tree’s shape, and minimize strain on the branches. Crown reduction is beneficial for maintaining the aesthetic appeal of trees while ensuring their safety and longevity.

By employing these essential techniques for tree trimming, you can enhance the health, structure, and appearance of your trees. It is crucial, however, to remember that proper training and knowledge are essential for successful tree trimming.

Environmental Benefits of Proper Tree Care

Proper tree care, including tree removal and tree trimming, can have significant environmental benefits. By understanding and implementing nature’s transformational techniques, we can help preserve and enhance our natural surroundings. Let’s explore some of the key benefits below.

-

Enhancing Air Quality: Trees play a crucial role in maintaining clean and healthy air. Through the process of photosynthesis, they absorb carbon dioxide and release oxygen, acting as natural air filters. By properly caring for trees, we ensure their optimal health and maximize their ability to purify the air we breathe.

-

Conserving Water: Trees are excellent at conserving water resources. They act as natural sponges, absorbing rainwater and reducing runoff that can lead to soil erosion and water pollution. By regularly maintaining and trimming trees, we promote their overall strength and resilience, enabling them to efficiently absorb and retain water for the surrounding ecosystem.

-

Supporting Biodiversity: Trees provide a vital habitat for countless species of birds, insects, and other wildlife. By preserving and caring for trees, we safeguard these habitats and the biodiversity they sustain. Proper tree care techniques such as selective pruning and responsible tree removal help maintain a healthy balance between trees, wildlife, and the overall ecosystem.

In conclusion, proper tree care, encompassing both tree removal and tree trimming, offers numerous environmental benefits. By recognizing and implementing nature’s transformative mechanisms, we can contribute to cleaner air, improved water conservation, and the preservation of biodiversity in our natural surroundings.

The Ultimate Party Room Rental Guide

Planning a party or event can be an exciting but sometimes overwhelming experience. One of the key decisions you’ll need to make is choosing the right venue or party room. With so many options available, it’s important to have a guide that simplifies the process and helps you find the ultimate party room rental. Whether you’re organizing a birthday celebration, a corporate event, or a milestone occasion, this article aims to provide you with everything you need to know about venue rentals and give you the confidence to make the best choice. From understanding the factors to consider when selecting a party room to exploring popular rental venues in different cities, we’ve got you covered. So let’s dive in and uncover the secrets to an unforgettable event venue!

Factors to Consider when Choosing a Party Room

When selecting a party room for your special event, there are several important factors to keep in mind. These considerations will help ensure that you find the perfect venue that meets your needs and creates the ideal atmosphere for your celebration. Here are some key factors to consider:

-

Capacity: First and foremost, you’ll want to determine the capacity of the party room. Consider the number of guests you are expecting and ensure that the venue can comfortably accommodate everyone. You don’t want a space that feels overcrowded or too spacious for your event.

-

Location: The location of the party room is crucial. Think about the convenience for your guests and how easy it will be for them to reach the venue. Is it centrally located or close to major transportation hubs? Additionally, consider the surrounding area; is it in a safe and desirable neighborhood?

-

Amenities and Facilities: Take a close look at the amenities and facilities offered by the party room. Does it have the necessary equipment for your event, such as sound systems, projectors, or lighting options? Are there enough restrooms available? It’s crucial to ensure that the venue can provide the necessary amenities to support your specific requirements.

By carefully considering these factors, you can ensure that you find the perfect party room for your event. Remember to also consider your budget, the availability of the venue, as well as any additional services offered. Investing time in the selection process will help create an unforgettable experience for you and your guests.

Tips for Finding the Perfect Venue Rental

-

Research the Options: Start your search for the perfect venue rental by conducting thorough research. Look for venues that align with the type of party or event you are planning. Consider factors such as capacity, location, amenities, and ambiance. Look for online listings, ask for recommendations from friends and family, and check out social media platforms where venues often showcase their offerings.

-

Visit Potential Venues: Once you have shortlisted a few potential venues, make it a point to visit them in person. This will give you an opportunity to see the space firsthand and assess whether it meets your requirements. Take note of the layout, cleanliness, and overall condition of the venue. Don’t hesitate to ask questions and seek clarification about any doubts or concerns you may have.

-

Consider the Logistics: When choosing a venue rental, it’s essential to consider the logistical aspects. Evaluate the parking facilities, accessibility for guests, and availability of public transportation options nearby. Also, factor in whether the venue offers additional services such as catering, audiovisual equipment, or event planning assistance. These facilitie can add convenience and make your party planning process smoother.

Remember, finding the perfect venue rental is crucial for creating a successful and memorable event. Taking the time to research, visit, and consider the logistics will help you make an informed decision and ensure a seamless party experience.

How to Make the Most of Your Party Room Rental

-

Get creative with the decorations

Decorations play a crucial role in setting the ambiance for your party. To make the most of your party room rental, let your creativity shine by choosing decorations that match the theme or atmosphere you want to create. Whether it’s streamers, balloons, or themed props, carefully selecting and arranging decorations can transform an ordinary space into a festive party room that your guests will love. -

Utilize the available amenities

When booking a party room rental, take full advantage of the amenities provided. Check if the venue offers a sound system, lighting options, or a built-in bar area. Using these facilities can enhance the party experience and make it easier for you to entertain your guests. Make a list of what’s available and plan your party activities around them to make the most out of what the venue has to offer. -

Plan engaging activities

To ensure your guests have a great time, plan interactive and engaging activities that cater to their interests. Consider incorporating fun games, dance-offs, or even hiring a professional entertainer to keep the party atmosphere lively. By keeping your guests entertained and active, you’ll create lasting memories and make the most of your party room rental.

Remember, the key to making the most of your party room rental is to add your personal touch, utilize the available amenities, and plan activities that ensure everyone has a fantastic time. With a combination of creativity, resourcefulness, and careful planning, your party will be an unforgettable event that will be talked about for years to come.

Exploring the Perfect Party Space: A Venue Rental Guide

Planning a party can be an exciting yet daunting task. From deciding on the guest list to choosing the perfect theme, there are countless elements that contribute to creating a memorable event. However, one of the most crucial aspects is selecting the ideal party space, as it sets the stage for the entire celebration. Whether you’re hosting a small gathering or a grand soiree, finding the right venue can make all the difference. In this venue rental guide, we will explore the various factors to consider when searching for the perfect party room, ensuring that your event is a resounding success

Factors to Consider

When it comes to choosing the perfect party space for your event, there are several factors that you should consider to ensure everything goes smoothly. The venue rental process involves careful planning and decision-making to create an unforgettable experience for your guests. Here are some key factors to keep in mind:

-

Location: One of the first things to consider is the location of the party space. It should be easily accessible for your guests, with convenient transportation options. If the venue is centrally located, it will be more convenient for everyone to attend and ensure a higher turnout. Additionally, consider the parking facilities available nearby to accommodate the needs of your attendees.

-

Capacity: Understanding the capacity of the venue is crucial to ensure that it can comfortably accommodate all of your guests. Consider the type of event you are hosting and the number of people you expect to attend. You don’t want the space to feel overcrowded or too empty, so make sure the venue’s capacity aligns with your guest list.

-

Amenities and Services: Different venues offer various amenities and services, so it’s essential to consider what is included in the rental package. Look for features like audiovisual equipment, a stage, a dance floor, or a bar area, depending on your event requirements. Also, check if the venue provides catering services or if you have the flexibility to bring in your own food and beverages.

By carefully considering these factors, you can find the perfect party space that suits your needs and sets the stage for an amazing celebration. Planning ahead and understanding your requirements will ensure a successful event that leaves a lasting impression on your guests. Keep these factors in mind as you navigate through the venue rental process and create the ultimate party experience.

Types of Venues

-

Indoor Venues:

Party Room

Indoor venues are ideal for parties and events that require a controlled environment. These venues offer protection against unpredictable weather conditions, making them a popular choice for parties. With a variety of options to choose from, such as banquet halls, hotels, and community centers, indoor venues provide a comfortable and well-equipped space for hosting parties of different sizes. -

Outdoor Venues:

Outdoor venues provide a unique and refreshing atmosphere for parties. From beautiful gardens and scenic parks to beachfronts and rooftops, these venues offer a natural and picturesque setting. Outdoor venues are perfect for daytime parties, especially during warmer seasons when guests can enjoy the fresh air and stunning views. When considering an outdoor venue, it is important to have a backup plan in case of inclement weather. -

Unique Venues:

For those looking for something extraordinary, unique venues add a touch of excitement and charm to any party. They can range from historic buildings, art galleries, and museums to farms, wineries, and even theme parks. Choosing a unique venue can create a memorable experience for guests and make your party stand out. However, keep in mind that certain unique venues may have specific regulations or limitations that need to be considered when planning your event.

Questions to Ask Venues

- Availability and Booking:

- Is the venue available on the date and time I need for my event?

- How far in advance should I book the venue?

- What is the duration of the rental period?

- Facilities and Amenities:

- What type of furniture and equipment are provided with the rental?

- Are there any restrictions on decorations or additional equipment that I can bring?

- Are there designated areas for catering or food preparation?

- Pricing and Policies:

- What is the total cost of renting the venue? Are there any additional fees?

- What is the payment schedule and cancellation policy?

- Are there any restrictions on noise levels or the use of certain equipment?

Remember, asking these questions will help you make an informed decision about the perfect party space for your event.

- « Previous Page

- 1

- …

- 167

- 168

- 169

- 170

- 171

- …

- 376

- Next Page »