In an era where security concerns are at an all-time high, the demand for advanced remote monitoring and surveillance systems has surged. These technologies have evolved significantly, providing users with powerful tools to ensure their safety and keep a vigilant eye on their surroundings. As we forge ahead into a future laden with innovation, the capabilities of these systems are becoming increasingly sophisticated while remaining accessible to the average consumer.

Amcrest products are at the forefront of this movement, exemplifying a perfect blend of functionality, user-friendliness, and affordability. By bridging the gap between high-end performance and ease of use, Amcrest offers solutions that empower individuals and businesses alike to monitor their environments effectively. The future of remote monitoring is not just about enhancing security; it is about reimagining how we interact with these systems and the peace of mind they can provide.

The Evolution of Surveillance Technology

Surveillance technology has undergone a remarkable transformation over the years, evolving from rudimentary systems to sophisticated setups that cater to a variety of needs. Early surveillance methods relied heavily on human operatives and basic recording equipment, which limited their effectiveness and scope. These systems were not only labor-intensive but also costly, making them accessible only to a select few. As technology advanced, the introduction of video cameras in the late 20th century revolutionized the field, allowing for more extensive monitoring capabilities.

With the advent of the internet and digital technologies, the surveillance landscape experienced an unprecedented shift. The integration of IP cameras enabled users to access live feeds remotely, significantly enhancing the convenience and utility of surveillance systems. This shift not only broadened access for consumers and businesses alike but also introduced features such as motion detection, night vision, and advanced data storage solutions. As a result, users began to expect more from their surveillance systems, paving the way for innovations that focus on ease of use and enhanced functionalities.

Today, advanced remote monitoring and surveillance systems, like those offered by Amcrest, are at the forefront of this evolution. They combine high-definition video quality, user-friendly interfaces, and affordability, making them appealing to both amateur users and professional organizations. These systems not only ensure safety and security but also adapt to the growing demands for reliable monitoring while maintaining user accessibility. As technologies continue to advance, the future of surveillance promises even more capabilities that will further bridge the gap between effectiveness and ease of use.

Amcrest: A Leader in Remote Monitoring

Amcrest has established itself as a prominent player in the realm of advanced remote monitoring and surveillance systems. With a focus on bridging the gap between powerful capabilities and user-friendly experiences, their products cater to a wide audience ranging from homeowners to businesses. The combination of affordability and innovative technology positions Amcrest as a go-to brand for those seeking reliable security solutions.

One of the standout features of Amcrest products is their ease of use. Many customers appreciate the straightforward installation process, which often requires minimal technical skills. The intuitive interface of their software and mobile applications simplifies monitoring tasks, allowing users to access live feeds, receive alerts, and review recorded footage with ease. This user-centric design underscores Amcrest’s commitment to making advanced surveillance accessible to everyone.

Moreover, Amcrest continually invests in research and development to enhance their product offerings. From high-resolution cameras with night vision capabilities to smart integration with other smart home devices, their diverse lineup meets the evolving needs of consumers. By prioritizing both advanced technology and customer satisfaction, Amcrest not only leads the market but also shapes the future of remote monitoring solutions.

Key Features of Amcrest Products

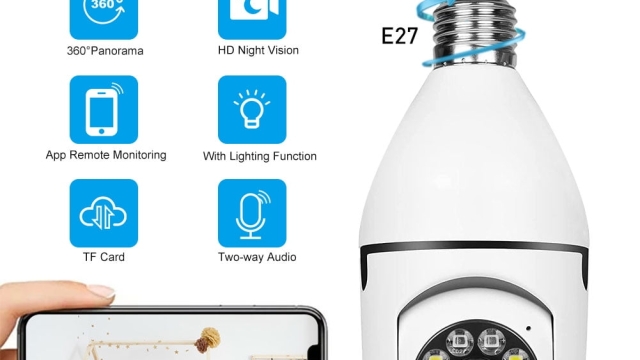

Amcrest products are designed with cutting-edge technology that ensures high-quality video surveillance. With resolutions reaching up to 4K, users can experience crystal clear imagery that captures fine details, making it easier to identify people and objects. Additionally, many Amcrest cameras offer night vision capabilities, allowing for effective monitoring even in low-light conditions. This ensures that no matter the time of day, users have a reliable view of their surroundings.

Another standout feature of Amcrest products is their user-friendly interface, which simplifies the setup and management of surveillance systems. With the Amcrest View app, users can access their cameras from anywhere, allowing for real-time monitoring directly from their smartphones or tablets. This accessibility promotes peace of mind, as users can check in on their properties easily, receive notifications of any unusual activity, and review recorded footage at their convenience.

Affordability is a key aspect of Amcrest’s philosophy, making advanced surveillance technology accessible to a broader audience. The combination of high performance and competitive pricing means that both residential and commercial users can invest in quality monitoring systems without breaking the bank. This balance of advanced features and cost-effectiveness makes Amcrest products an appealing choice for anyone looking to enhance their security measures.

The Future of Monitoring Solutions

As surveillance technology continues to evolve, the future of monitoring solutions is poised to become even more sophisticated and user-friendly. Advanced remote monitoring systems, such as those offered by Amcrest, are integrating artificial intelligence and machine learning to enhance their capabilities. These systems will be able to detect unusual activity, analyze patterns in real-time, and send alerts to users, allowing for proactive security measures. This level of intelligence not only improves safety but also reduces the need for constant human oversight.

Moreover, the rise of IoT devices is transforming how surveillance systems operate. With interconnected devices, Amcrest products can seamlessly communicate with other smart home technologies, creating a comprehensive security ecosystem. Users will benefit from centralized control through intuitive mobile applications, making the management of their security systems easier than ever. This connectivity will also allow for remote access from anywhere in the world, ensuring peace of mind irrespective of location.

Affordability remains a crucial aspect of the future of monitoring solutions. Innovations in technology and manufacturing are driving down costs, allowing high-quality surveillance systems to become accessible to a broader audience. Amcrest is at the forefront of this trend, offering systems that balance advanced features with cost-effectiveness. As a result, individuals and businesses alike will have the tools they need to enhance their security practices without compromising on quality.

In today’s visually driven world, businesses are increasingly focusing on

In today’s visually driven world, businesses are increasingly focusing on