Owning a business entails many responsibilities, one of which is protecting your valuable assets. As a business owner, you understand the importance of commercial property insurance in safeguarding your establishment against unfortunate events. Whether you own a restaurant, retail store, office space, or any other commercial property, having adequate insurance coverage is vital to mitigating financial risks and ensuring the continuity of your business operations.

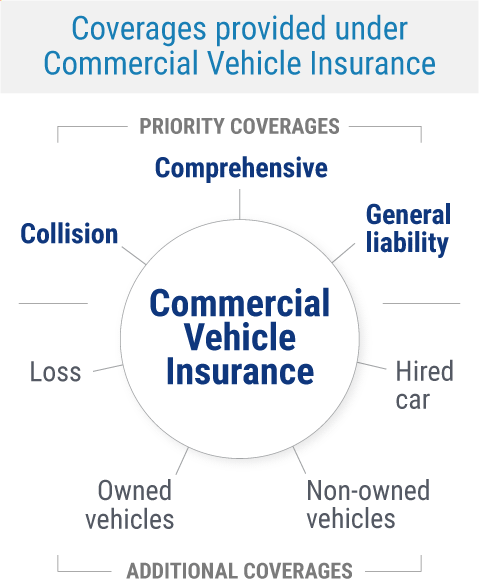

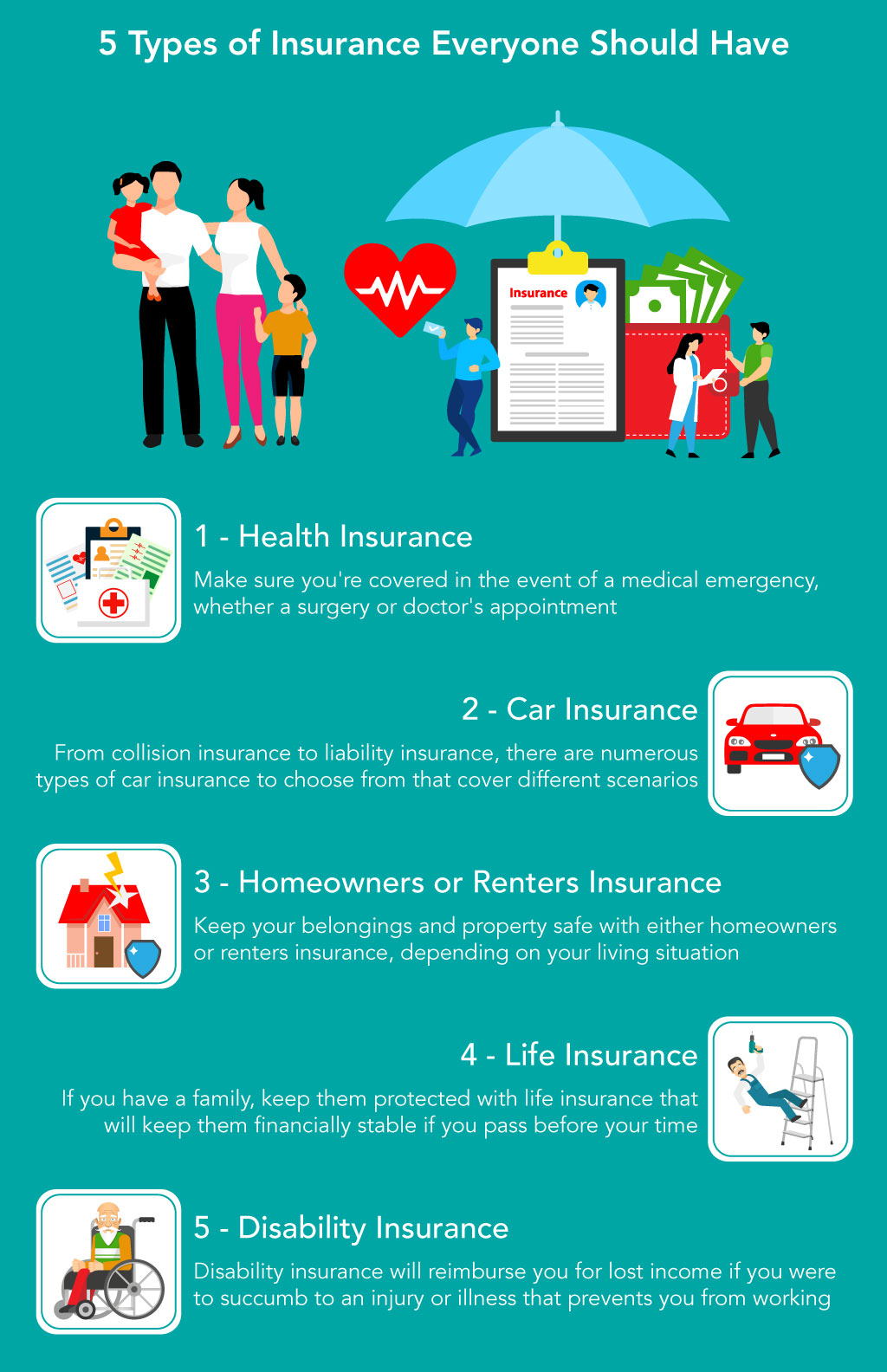

Commercial property insurance is designed to provide coverage for your physical assets, such as buildings, equipment, inventory, and furniture, against various perils like fire, theft, vandalism, or natural disasters. This type of insurance goes beyond just protecting the physical structure; it also covers the contents within it. Additionally, commercial property insurance often includes coverage for business interruption, offering financial assistance to help you get back on track in the event of a covered loss that disrupts your operations.

Moreover, commercial property insurance is often bundled with general liability insurance, which protects your business against claims for third-party bodily injury or property damage. This combined coverage not only shields your physical assets but also shields your business from potential liability lawsuits that may arise.

For instance, if you own a restaurant, commercial property insurance can provide coverage for your building, kitchen equipment, furniture, and even the food inventory. Meanwhile, general liability insurance can protect you from claims if a customer slips and falls in your establishment or if a customer experiences food poisoning. Having comprehensive coverage that combines commercial property insurance with general liability insurance ensures that you are safeguarded from the various risks that your business may face.

In conclusion, investing in commercial property insurance is a wise decision for any business owner seeking to protect their assets and mitigate potential risks. With the right coverage, you can rest assured that your business is secure and that you are prepared to handle unexpected incidents. Whether it’s a restaurant, retail store, or office space, don’t overlook the importance of commercial property insurance in safeguarding your business’s future.

Understanding Commercial Property Insurance

Commercial property insurance is an essential safeguard for businesses of all sizes, providing protection for physical assets such as buildings, equipment, and inventory. It is designed to cover the costs associated with property damage or loss due to various events, including fires, theft, vandalism, and natural disasters. Let’s delve into the key aspects of commercial property insurance and understand why it is crucial for the long-term success of your business.

First and foremost, commercial property insurance offers financial protection by compensating you for the repair or replacement of damaged property. In the unfortunate event of a fire or other covered incident, this insurance can save your business from bearing the entire burden of the loss. By having the appropriate coverage in place, you can quickly and efficiently restore your business operations and minimize any potential disruption to your customers.

Moreover, commercial property insurance also provides coverage for liabilities that may arise from accidents or injuries on your premises. For instance, if a customer slips and falls on a wet floor in your restaurant, general liability insurance included in your commercial property policy can cover the resulting medical expenses and legal fees. This protection is particularly important for businesses like restaurants, where accidents can occur more frequently due to the nature of the industry.

In addition to property and liability coverage, commercial property insurance can be tailored to meet the unique needs of your business. Whether you own a retail store, office space, or a manufacturing facility, you can customize your policy to include specific protections for your industry. For example, a restaurant owner may opt for insurance coverage that specifically addresses risks associated with food spoilage, equipment breakdown, or liquor liability. By understanding the specific risks your business faces, you can ensure adequate coverage and peace of mind.

In conclusion, commercial property insurance is an invaluable asset that protects your business from unforeseen events and provides the necessary financial support to recover and rebuild. By understanding the extent of coverage provided and customizing it to suit your business’s needs, you can secure a strong foundation for your business’s long-term success. Don’t wait until it’s too late; invest in commercial property insurance today and safeguard your business against the unexpected.

The Role of General Liability Insurance

General Liability Insurance plays a crucial role in safeguarding businesses from various unforeseen liabilities and risks. It provides coverage for incidents that may occur on the business premises or as a result of business operations. This insurance is essential for protecting your commercial property and ensuring the long-term success of your business.

One of the primary benefits of General Liability Insurance is its ability to cover bodily injury claims. Accidents happen, and if a customer or visitor gets injured on your property, this insurance can help cover medical expenses, legal fees, and potential settlements or judgments. By having General Liability Insurance in place, you can mitigate the financial burden that these types of incidents can bring.

In addition to bodily injury claims, General Liability Insurance also provides coverage for property damage. It can help protect your business if you accidentally damage someone else’s property while conducting your operations. Whether it’s a client’s expensive equipment or a neighboring building, having this insurance can ensure that you won’t have to bear the full cost of repairing or replacing the damaged property.

Moreover, General Liability Insurance often extends its coverage to include personal and advertising injury claims. This means that if someone claims that your business has caused them harm through defamation, copyright infringement, or wrongful eviction, this insurance can help cover your legal defense costs and potential settlements.

By securing General Liability Insurance, you demonstrate your commitment to protecting your business, clients, and assets. It provides essential coverage for a variety of potential risks that could arise during the course of your daily operations. So, regardless of whether you run a restaurant, a retail store, or any other type of business, having General Liability Insurance is key to ensuring the long-term stability and success of your enterprise.

Insurance Considerations for Restaurants

When it comes to running a successful restaurant, having the right insurance coverage can be vital for protecting your business from unexpected risks. Commercial property insurance is especially important for restaurants, as it provides coverage for both the physical property and equipment used in your establishment.

One key aspect of commercial property insurance to consider for your restaurant is coverage for potential damage or loss due to common risks such as fire, theft, or severe weather. This ensures that your property, including your building and its contents, is protected against these unforeseen events, allowing you to recover and continue serving your customers.

Additionally, it is essential to have general liability insurance for your restaurant. This coverage helps protect your business in the event of accidents or injuries that may occur on your premises. For instance, if a customer slips and falls in your restaurant, general liability insurance can help cover medical expenses, legal fees, and any potential damages related to the incident.

Another important insurance consideration for restaurants is specialized coverage tailored to the unique risks associated with the food industry. Insurance policies specifically designed for restaurants typically include coverage for food contamination, spoilage, or even property damage caused by equipment failures. These additional coverages can provide peace of mind, knowing that your restaurant is protected against unexpected events that could potentially lead to financial loss.

In conclusion, obtaining the right insurance coverage is crucial for any restaurant owner looking to protect their business from potential risks. Commercial property insurance, general liability insurance, and specialized coverage for the food industry are all important considerations to ensure the long-term success and security of your establishment.