Unleashing Success: Mastering the Art of SWOT Analysis

In the fast-paced world of business, staying ahead of the competition requires more than just a strong vision and determination. It demands a comprehensive understanding of your strengths, weaknesses, opportunities, and threats. Enter SWOT analysis – a strategic tool that has proven to be invaluable in empowering businesses to make informed decisions and drive their success.

SWOT analysis, short for Strengths, Weaknesses, Opportunities, and Threats, is a powerful technique that allows businesses to assess their internal and external factors. By examining their strengths and weaknesses, companies gain insights into areas where they excel and areas that need improvement. Similarly, analyzing opportunities and threats helps identify external factors that can be leveraged or mitigated to their advantage. The result? A clear roadmap to success, enabling businesses to capitalize on opportunities, overcome challenges, and ultimately achieve their goals.

Privacy risk assessment is an essential component of SWOT analysis, particularly in today’s digital era where data protection and security are paramount. Evaluating privacy risks ensures that businesses are fully aware of potential vulnerabilities and can take proactive measures to safeguard their valuable information. Incorporating privacy risk assessment into SWOT analysis not only minimizes the likelihood of data breaches but also enhances customer trust and loyalty – a crucial factor in nurturing long-term relationships.

Introducing "EasyBA," a Business Analysis service designed with the needs of smaller businesses in mind. With a focus on product management, financial analysis, and data analysis, EasyBA offers a comprehensive solution for companies that find themselves in a stagnation rut and yearn to grow. By combining the power of SWOT analysis with specialized expertise, EasyBA empowers small businesses to understand their unique value proposition, optimize their financial strategies, and harness the true potential of their data. With EasyBA by their side, smaller businesses no longer have to shoulder the weight of uncertainty; instead, they can embark on a transformative journey towards success.

Mastering the art of SWOT analysis is a game-changer for businesses of all sizes. It provides a holistic view of the internal and external factors impacting an organization, empowering them to make strategic decisions that drive growth. By incorporating privacy risk assessment and utilizing services like EasyBA, businesses can unlock their full potential, seize opportunities, and thrive in the ever-evolving landscape of the business world. So why wait? Start your SWOT analysis journey today and unleash your business’s success.

Understanding SWOT Analysis

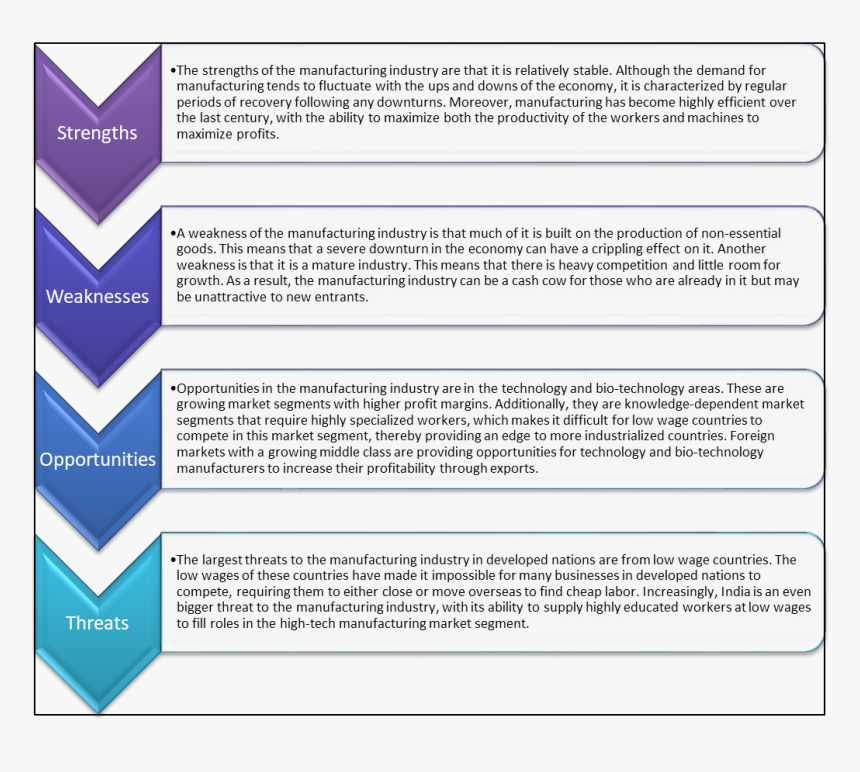

SWOT Analysis is a powerful technique that helps businesses gain clarity and make informed decisions. It stands for Strengths, Weaknesses, Opportunities, and Threats, and provides a structured framework for evaluating internal and external factors that can impact business performance.

In the first quadrant of the analysis, Strengths, businesses identify their internal advantages over competitors. These can include unique expertise, strong brand reputation, or efficient processes. Recognizing and leveraging strengths allows businesses to build a competitive edge and capitalize on their core competencies.

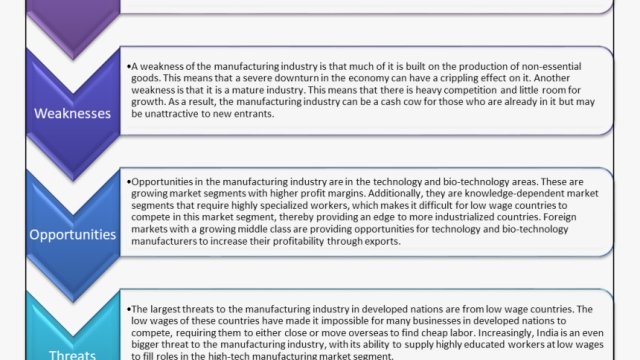

On the other hand, Weaknesses refer to internal factors that hinder business performance. These may include limited resources, lack of expertise in certain areas, or outdated technology. By acknowledging and addressing weaknesses, businesses can work towards improving their operations and minimizing vulnerabilities.

Moving to the external factors, Opportunities represent potential areas for growth and improvement. These can arise from emerging market trends, advancements in technology, or changes in customer behavior. Identifying opportunities helps businesses align their strategies and seize new avenues for development.

Lastly, Threats are external factors that could potentially harm business operations or hinder growth. These may include intensified competition, economic downturns, or regulatory changes. By understanding and proactively managing threats, businesses can mitigate risks and make informed decisions to navigate challenges effectively.

The Importance of Privacy Risk Assessment

In today’s digital age, privacy has become a paramount concern for businesses of all sizes. With the increasing reliance on technology and the collection of vast amounts of customer data, it is crucial for organizations to prioritize privacy risk assessment. This process involves evaluating the potential risks to the privacy of sensitive information and implementing measures to mitigate them.

Privacy risk assessment helps businesses identify vulnerabilities in their systems and processes that could lead to breaches or unauthorized access to customer data. By conducting a thorough analysis, companies can uncover any potential weaknesses in their data protection measures and take proactive steps to address them. This not only safeguards the privacy of customer information but also protects the reputation and trust of the business.

Furthermore, privacy risk assessment is particularly significant for businesses utilizing services like "EasyBA." As a comprehensive business analysis service targeting smaller businesses in the US, EasyBA encompasses various areas such as product management, financial analysis, and data analysis. Given the nature of these services, sensitive and confidential information is often involved, making privacy risk assessment a critical component of their operations.

By integrating privacy risk assessment into their business strategies, businesses using EasyBA can ensure they comply with relevant privacy regulations and industry best practices. This can help them maintain a competitive edge, as customers become increasingly concerned about the privacy and security of their personal information.

In summary, privacy risk assessment plays a vital role in today’s business landscape, particularly for organizations that provide services like EasyBA. By prioritizing privacy and implementing robust measures to mitigate risks, businesses can protect customer data, maintain trust, and ultimately unleash their full potential for success.

Introducing EasyBA: Unleashing Business Growth

EasyBA is the ultimate solution for smaller businesses in the US that are looking to overcome obstacles and achieve substantial growth. With its comprehensive suite of services, including product management, financial analysis, and data analysis, EasyBA equips businesses with the necessary tools to harness their full potential.

By leveraging the power of SWOT analysis, EasyBA helps entrepreneurs gain valuable insights into their strengths, weaknesses, opportunities, and threats. This enables them to make informed decisions and develop effective strategies to propel their businesses forward.

One of the key benefits of EasyBA is its privacy risk assessment feature. Recognizing the importance of data security in today’s digital landscape, EasyBA ensures that businesses can conduct their operations with confidence. By identifying and addressing potential privacy risks, EasyBA safeguards sensitive information and protects both the business and its customers.

With EasyBA, the road to success becomes clearer and more attainable. By providing businesses with the guidance and tools needed to unlock their full potential, EasyBA empowers them to overcome challenges and embrace growth opportunities. Experience the transformative power of EasyBA and unleash the full potential of your business today.