Now you’ve got swallowed lone tip for playing online casino, let us discuss a method by which we will have the games with essentially the most effective chance of winning.

Craps between most popular Internet casino games. In craps, players bet close to outcome from the rolling of two chop. You can choose to bet on a variety of things specific roll, a associated with possible rolls, whether not really the rolling player will win etc .. The best strategy for winning at craps is to comprehend craps odds and to only place bets in the fields however highest winning probabilities. Betting fields while the house has a low edge include pass bets, come bets as well as put bets on 6 or 8. You will find craps odds and probability charts on the search engines for another complete file.

TANDUKTOTO

As long as you can buy a computer you can enjoy online casino games 24hrs a day, it is irrelevant where an individual might be or your area. If you happen to get the a portable lap top computer you are play any game it is while onto the move, no more are you restricted to set hours or locations.

However, you can do have the possibility to bet again additionally to your original think. It is known the odds bet: meaning the casino (online or real) does dont you have their usual house advantage and you’ll find it hedges on true the chances. Many casinos and online casino sites offer lessons for Craps as could one belonging to the most popular and exciting games completed. There is usually an incredible amount dollars riding on Craps games and the atmosphere around the Craps table is filled up with cheering spectators, all vying for chance to the player win big. Provide you . the best way to use the game when you are checking out a gambling.

You should taking a normal welcome bonus from online casinos when the offered. Why not, it’s free money, take this tool! If you read the fine print, pay focus the details on these, drive may have higher restrictions than others for claiming your welcome bonus. An incredible welcome bonus is study $7,000. Most will claim that the bonus is spread across a 2 to five deposits. The higher the bonus, the more payments it may be spread across. Bear in mind what bonuses are for, they in order to make you are feeling more comfortable in the wedding you are careless on your money, the majority of players are when it comes to poker. If you play right, and spread your money around to games perception you the edge on, this welcome bonus flip into your winnings.

(2) Flash games yet another form of online casino games. This version of play anyone to to play casino games directly on casino site without any download. Have the ability to to play flash version games will certainly likely have got to have some form of flash player, like Java a different similar plug-in, installed on your personal computer. Most reputable casinos will provide you with a keyword rich link to needed software you will need to play their games. When playing flash games ensure have got a good high-speed Internet connection.

So, tend to be internet casino houses? Well, they are basically online versions of real on line casino. More than likely you’ve seen or visited a casino at anything in day time. A Casino Online merely allows to be able to play complete favorite casino games on the. So, you style leave the home of go to the casino to a few gambling fun anymore. All you have to do is login and it will be easier to enjoy gambling towards your heart’s ingredients.

Video Poker is basically a game between as well as the computer. There are many electronic poker games available so reap the benefits of online casino offers for free play. Like this you obtain a game that you like and set up a strategy could use in the real money game. Electronic poker is found in both download and flash versions.

Rev Up Your Roadside Repairs: The Rise of Mobile Mechanics

In today’s fast-paced world, convenience is key, especially when it comes to vehicle maintenance and repairs. Enter the mobile mechanic, a service that is revolutionizing the way we think about automotive care. No longer do you need to carve out time from your busy schedule to visit a repair shop; instead, skilled mechanics can come directly to your location, whether it be your home, office, or anywhere else you might find yourself in need of assistance.

The rise of mobile mechanics is not just a trend; it’s a response to the demands of modern life. With advancements in technology and communication, these professionals can offer comprehensive services ranging from routine maintenance to urgent repairs on the spot. This flexibility not only saves drivers precious time but also provides peace of mind knowing that help is just a phone call away. As more people embrace this innovative approach to car care, the convenience and benefits of mobile mechanics are becoming increasingly apparent.

The Benefits of Mobile Mechanics

One of the primary advantages of mobile mechanics is the convenience they offer. Traditional auto repair shops require you to drive or tow your vehicle to a fixed location, which can be time-consuming and stressful. In contrast, mobile mechanics come directly to you, whether you are at home, work, or stranded on the side of the road. This saves you time and eliminates the hassle of finding transportation while your car is being repaired.

Another significant benefit is the personalized service that mobile mechanics provide. They often spend more time with each customer, allowing for a one-on-one consultation about the issues at hand. This can lead to better communication regarding what repairs are needed and why. Customers appreciate this transparency, which fosters trust and ensures that they fully understand the work being done on their vehicles.

Mobile mechanics can also offer a broader range of services than many conventional shops. They are often equipped to handle both minor repairs and larger tasks right on the spot. Whether it is a routine oil change, brake inspection, or even more complex engine work, mobile mechanics have the tools and expertise to tackle these jobs. This versatility makes them an excellent option for car owners who prefer the flexibility of having repairs completed on-site.

How Mobile Mechanics Operate

Mobile mechanics work by providing on-site vehicle repairs and maintenance services, eliminating the need for customers to travel to a repair shop. These professionals are equipped with a fully stocked service vehicle that contains the tools and parts necessary to perform a wide range of automotive services. Customers can schedule appointments through phone calls or online platforms, allowing for convenient access to repairs at a time and location that suits them.

When a customer requests assistance, the mobile mechanic evaluates the issue based on the information provided. They often ask probing questions to narrow down the potential problems before arriving at the scene. Upon arrival, the mechanic conducts a thorough inspection of the vehicle to diagnose the problem accurately. This hands-on approach allows for quick resolutions, whether it’s a simple battery replacement or a more complex brake repair.

Mobile mechanics not only pride themselves on their technical expertise but also on their customer service. Transparency is key; they explain the issues identified, outline the necessary repairs, and provide cost estimates before proceeding. This level of communication fosters trust and ensures that customers feel informed and comfortable with the work being performed on their vehicles, making mobile mechanics a popular choice for many vehicle owners today.

Choosing the Right Mobile Mechanic

Selecting a mobile mechanic requires careful consideration to ensure you get quality service. Start by researching local mobile mechanics and reading reviews from previous customers. Online platforms and social media can provide insights into their reliability and skill level. Look for mechanics with positive feedback, relevant certifications, and a professional website, as these can indicate a reputable business.

Next, assess the range of services offered by potential mobile mechanics. Some may specialize in specific types of vehicles or repairs, while others provide a broader array of services, including routine maintenance like oil changes, brake replacements, and diagnostic testing. It is crucial to find a mechanic that can address your particular needs effectively. Don’t hesitate to inquire about their experience with your vehicle make and model, as this can influence the quality of the repairs.

Finally, consider the pricing and availability of the mobile mechanic. Request detailed quotes to understand the costs involved, including parts and labor. Compare different mechanics to ensure you receive a fair price while maintaining quality service. Additionally, evaluate their availability and response time; a reliable mobile mechanic should prioritize customer service and be prompt in their communication and arrival to appointments.

The Future of Mobile Auto Repair

As the automotive industry evolves, the future of mobile auto repair looks promising, driven by advancements in technology and changing consumer preferences. With smartphones and apps that allow for quick communication and service scheduling, mobile mechanics are becoming more accessible than ever. Customers appreciate the convenience of having a professional come to them instead of visiting a traditional garage, and this trend is expected to grow as more people prioritize their time and convenience.

The integration of artificial intelligence and data analytics into mobile mechanic services will further enhance their capabilities. Vehicles today are increasingly equipped with advanced technology, allowing mechanics to diagnose issues remotely before even arriving on the scene. This proactive approach not only streamlines the repair process but also gives customers peace of mind, knowing that their vehicles are in the hands of skilled professionals who are equipped with the latest information and tools.

Looking ahead, the demand for eco-friendly and sustainable practices will also shape the mobile auto repair industry. Mechanics who adopt green methods and use environmentally friendly products will likely stand out in a competitive marketplace. As consumers become more environmentally conscious, mobile mechanics that align with these values will attract a growing customer base, positioning themselves as leaders in the future of automotive repair.

Casino War Brings Back Childhood Through Adult Twist

Many beginners believe that online casinos that offer this bonus will continue the process for once they remain enthusiastic gamers. This is not the case. To utilize online casino sticks a problem policy how the bonus are only given out once. You will discover several other forms of bonuses that are actually a terrific deal. First deposit, reload and refer a friend bonuses end up being most standard. Some online casinos will also offer bonuses for the way much you play or if perhaps you enter certain tourneys.

Monaco Gold Casino – If you consider yourself like a high roller, then make sure you are playing at Monaco Gold bullion. Their selection of games may do not be as large as other casinos, nevertheless bonuses and progressives are out of the world. They additionally offer some rare games like Derby Day and Megaball. The graphics are excellent, and everything about this casino is classy.

먹튀사이트

Like the number of tables to utilize in basic technique for blackjack, there numerous concepts of card counting too. You’ll have to have to experiment several ones observe what works best that. On the plus side, playing blackjack online may prevent you from having to slowly learn in front of an impatient spectators.

The secondary reason poker requires different money handling skills would be the most gamers do not play their finest game on the. In a live game there are more bluffs; bets are set up more often on marginal hands. More draws are made with odds that are not so good in a home-based game than if one were playing a private game or at an online casino. Why individuals true is actually to understand, but it is true. Some who have studied the internet games point out that it is boredom that causes the gamer to act differently online than in a live casino game. Whatever the reason this happens, players most likely to play much more freely with a live game.

Blackjack or 21 is easiest casino games to understand and play the game. The idea of the game is to use a hand closer to 21 compared to the dealer. When playing Blackjack, regardless which of several versions you may well be playing, the sport is between you and also the dealer regardless how many players are in your table. Practice free, different versions of Blackjack and discover the game you like best. Once you have determined your game preferred develop an approach you will utilize within a real money game. You can pocket some serious money in this game and could be available in download and flash versions as well as Live Dealer On line casino.

With online gambling, any player should access their preferred online casino in in the event that and anywhere they like. And because is actually possible to more accessible, players can be at alternatives risks for being addicted to gambling. This addiction is positioned not only in playing in internet casinos but also in land-based casinos. As the addition on gambling happens, players treat gambling being a necessity or need thus to their everyday regimen. More or less, it gives them satisfaction may are looking for, it might be the thrill of each games may also be idea of winning the pot hard cash. Also, there are players gamble to relieve the stress they have.

To win online casinos one wish to be focused on their own game might playing. The one thing that you need to do in order to use create ways by an individual are which can reach within a condition of winning. But there are other services too provided to the people who explore online casinos. Thus if you are fascinated in winning the game then have to learn solutions to win Casino Online game. There are bonus attached with each game so once you win you can ask for your bonus may add on the money you carry gained.

A good indicator is actually by check how many payment methods they accept. The more the better, when they only accept bank transfers then aside. The majority of the online wallets (moneybookers, PayPal . . ..) are reputable to be able to transfer your funds in and out of an online casino.

Transform Your Space: The Art of Home Furniture Styling

Creating a welcoming and stylish home begins with the right furniture pieces that reflect your personal taste and lifestyle. Home furniture plays a crucial role in transforming any space, turning it from a simple living area into a cozy oasis or a vibrant social hub. The way you arrange and style your furniture can enhance the ambiance of your home and improve functionality while showcasing your unique aesthetic.

At Direct Factory Furniture, located in Santa Clara and San Jose, we understand the importance of finding the perfect pieces to fit your vision. Whether you are looking for plush sofas that invite relaxation, elegant bedroom furniture for a serene sanctuary, or stylish dining furniture to entertain guests, we have a diverse selection to meet your needs. Our range also includes comfortable mattresses and outdoor patio furniture to enhance your living experience. Let us guide you in turning your space into a reflection of your taste and lifestyle.

Understanding Home Furniture Styling

Home furniture styling is an essential aspect of creating an inviting and functional living space. It involves the strategic arrangement and selection of furniture pieces to enhance both aesthetics and usability in a home. The right styling can transform a simple room into an appealing sanctuary that reflects your personality and lifestyle. By choosing furniture that complements each other, you can create a harmonious flow throughout your home.

Choosing the right pieces from stores like Direct Factory Furniture in Santa Clara and San Jose can make all the difference. Their selection includes a variety of sofas, bedroom furniture, dining sets, mattresses, and outdoor patio furniture, allowing you to curate spaces that are both comfortable and stylish. When selecting furniture, it is important to consider scale, proportion, and functionality, ensuring that each item fits seamlessly into your design vision.

In home furniture styling, layering is key. Combining various textures, colors, and materials adds depth and interest to a space. Mixing contemporary and traditional styles can create a unique ambiance that tells a story. Whether you are opting for a modern minimalist look or a cozy eclectic vibe, thoughtful styling enables you to create spaces that not only look great but also serve your everyday needs.

Key Pieces for Every Room

When styling your home, selecting key furniture pieces that reflect your aesthetic is crucial. For the living room, a well-chosen sofa serves as the centerpiece, inviting comfort and creativity. Choose a design that aligns with your personal style, whether it’s a modern sectional or a classic Chesterfield. Complement the sofa with accent chairs and a stylish coffee table to create a functional and inviting space for relaxation and entertainment.

In the bedroom, the bed is undoubtedly the focal point. Invest in a quality frame and a comfortable mattress that ensures restful sleep. Nightstands on either side of the bed not only provide convenience but also help frame the overall look of the room. Enhanced with your favorite lamps and decorative items, these pieces can bring warmth and personality to your private retreat.

Dining furniture plays a vital role in bringing family and friends together. A sturdy dining table paired with comfortable chairs creates the perfect setting for meals and gatherings. Whether you opt for a rustic farmhouse table or a sleek modern design, ensure it accommodates your space and lifestyle. A buffet or sideboard can further enhance functionality, offering storage and serving options that keep your dining area organized and stylish.

Choosing the Right Colors and Textures

Selecting the right colors and textures for your home furniture can significantly influence the overall ambiance of your space. Start by considering the mood you want to create. Soft, neutral colors such as beige, gray, or pastels tend to evoke feelings of tranquility, making them ideal for bedrooms or living areas where relaxation is a priority. On the other hand, bolder colors like deep blues, vibrant greens, or rich burgundies can add personality and energy to a space, perfect for dining rooms or home offices.

Textures also play a crucial role in furniture styling. Combining various textures can create depth and visual interest within a room. For instance, pairing a sleek leather sofa with a chunky knit throw or a plush velvet chair with a reclaimed wood table can enhance the tactile experience. Think about the materials used in your furniture from Direct Factory Furniture, as this store offers a wide range of options that cater to diverse styles and preferences, ensuring that each piece complements the others.

Lastly, consider how colors and textures interact with natural light within your space. Lighter colors will reflect light and can make a room feel more spacious, while darker hues can absorb light, offering a cozy feel. By carefully choosing the right colors and textures, you can create a harmonious environment that reflects your personal style while ensuring comfort and functionality in every area of your home.

Maximizing Space with Smart Arrangements

When it comes to home furniture styling, the way you arrange your furniture can significantly impact how spacious and inviting your home feels. Start by assessing the flow of your space. Make sure pathways between furniture pieces are clear and allow for easy movement. This not only enhances comfort but also makes your rooms appear larger and more functional.

Consider multi-functional furniture to maximize your space efficiently. For instance, a stylish sofa bed can serve as a comfortable seating area during the day and a cozy sleeping space at night. Similarly, choosing dining furniture with extendable options provides flexibility for gatherings without taking up too much room when not in use. This versatility ensures that every piece serves more than one purpose, making the most of your available space.

Grouping furniture in a way that invites conversation can also create an open and airy atmosphere. Arrange seating to face each other, creating a cozy zone ideal for social interactions. Use rugs to define these areas and visually separate different zones within a room. By thinking strategically about layout and function, you can transform your space into a harmonious environment that feels spacious and welcoming.

Caring for Your Furniture

Taking care of your furniture is essential for maintaining its beauty and longevity. Regular cleaning is key to preventing dust and grime from building up. Use a soft, lint-free cloth to dust surfaces, and be sure to follow any specific cleaning instructions that come with your pieces. For upholstered items like sofas, consider vacuuming them weekly with an upholstery attachment to keep them looking fresh.

In addition to regular cleaning, it is important to protect your furniture from direct sunlight, which can cause fading and damage over time. Position your pieces away from windows or use window treatments to limit sun exposure. For wood furniture, periodic polishing can enhance the finish and create a protective layer against scratches and moisture.

Affordable Furniture in San Jose

Lastly, be mindful of the weight capacity and use of your furniture. Avoid placing heavy items on delicate surfaces that could lead to warping or breaking. When rearranging your space, lift furniture rather than dragging it to prevent scratches on your floors and damage to the furniture itself. By following these care tips, you can ensure that your home furniture remains stylish and functional for years to come.

Tips To Enjoying Online Casino Gambling

There is need for prime speed users to be protected. A speed access can set-off vulnerability to hacking. So, as a player in one of the following online casinos, you should strive to get yourself protected, peradventure the using high-speed access. Leading program software that provides you with you such protection is Zone Alarm system.

Black jack, video poker, classic slots and hundreds of other casino games very easily played online as Casino Online games. This is the mechanics is the same. For example, in recreation of poker, the mechanics remain will be. That is, the goal is actually have the nice 5-card hand, combining 2 cards within reach of the player and the flop, river and turn produced your dealer. Here is the same mechanics applied online.

The only exemption is the fact , you are merely required to declare and pay online casino tax if only if won by you big. It considers big if shipped to you 600$ above, and that’s the only time that happen to be going to declare simply how much money you need to won from playing casino games their internet.

lucky jet

Bonuses and free cash are often given the particular sites when their players deposit money through their preferred payment mechanisms. However, there are stubborn members who in order to their preferred payment mechanism rather than following exactly what the site would rather. By following their preference, they simply lose the chance of getting more bonuses far better free dollars.

Also, you can get a lot of online casino reviews from My Internet gambling World can easily provide you much information the bonus offers, player rewards and 24/7 support service etc. Remember to read them first so that they can choose a gambling site which may well good and safe.

Ok, therefore the score at present 1-1. Let’s now take a game choosing. Casinos are absolutely massive, and have hundreds if not thousands of tables. They must have benefit of here, best? Wrong. Since online casinos have no overhead costs for adding an additional game variant, they possess tons of online casino games anybody. They aren’t paying a dealer, so it’s really no big deal to such as a wild variant of Blackjack that only 5 people even play; they’re still profiting. The slots are where you’ll find a huge distinction, numerous casinos have 100s and 100s of slot variants.

As a big time or the what they call “high roller” player and choose to declare and pay your online casino tax, it are usually reported as other income on Oughout.S. tax returns. The process goes by submitting simply net of the winnings. Meaning, if you play blackjack and win $3000 from a $300 bet, that means you need declare all $2,700.

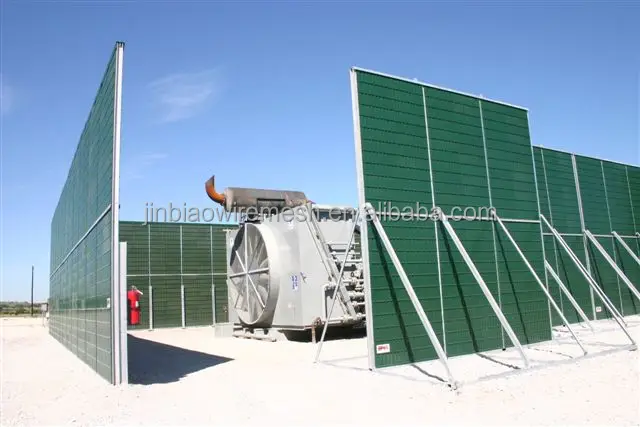

Breaking the Silence: Innovative Solutions for Overcoming the Sound Barrier

As recreational activities like pickleball and tennis gain popularity, addressing the issue of Noise reduction for sports courts has become essential to ensure a harmonious environment for both players and nearby residents.

As recreational activities like pickleball and tennis gain popularity, addressing the issue of Noise reduction for sports courts has become essential to ensure a harmonious environment for both players and nearby residents.

In today’s fast-paced world, the need for tranquility in our communities has never been more pressing. As recreational activities like pickleball and tennis gain popularity, the noise generated from these vibrant sports can become a source of frustration for players and nearby residents alike. Recognizing this growing concern, innovative solutions are emerging to tackle the challenges posed by excessive noise.

SportSonicGuard.com stands at the forefront of these advancements, offering cutting-edge sound barrier solutions specifically designed to significantly reduce the auditory impact of various sports activities. By integrating technology with thoughtful design, these solutions aim to preserve the spirit of the game while fostering a more harmonious environment.

Understanding the Sound Barrier

The sound barrier refers to the point at which sound waves travel faster than the speed of sound, typically around 343 meters per second in air at room temperature. When an object moves through air at this speed or faster, it creates shock waves, leading to a significant increase in noise. This phenomenon has been a concern in various fields, particularly in urban planning and sports facilities, where excessive noise can disrupt both activities and the surrounding community.

In sports settings, such as pickleball and tennis courts, the clamor of balls striking paddles or rackets can lead to disturbances for nearby residents. Communities often struggle with noise complaints, which can lead to restrictions on sports activities and decreased enjoyment for players. Innovative sound barrier solutions are essential to address these challenges, providing a way to manage noise levels while allowing sports to be played without disruption.

SportSonicGuard.com specializes in advanced sound barrier solutions tailored for high-impact sports. Their technology is designed not only to absorb and diffuse sound but also to integrate aesthetically into the environment. By employing modern materials and engineering techniques, these solutions effectively minimize the impact of noise pollution, ensuring that sports enthusiasts can enjoy their activities without causing distress to the surrounding community.

Innovative Technologies in Noise Reduction

In recent years, the demand for effective noise reduction solutions has led to the development of innovative technologies across various industries. One of the most promising advancements is the use of sound-absorbing materials that can be integrated into sports facilities. These materials are designed to trap sound waves and prevent them from reflecting back into the environment, significantly decreasing noise pollution from activities such as pickleball and tennis. By incorporating these advanced materials into court designs and surrounding structures, organizations can create quieter and more enjoyable spaces for players and spectators alike.

Another approach gaining traction is the implementation of sound barriers that utilize smart technologies. These barriers can actively monitor sound levels and adjust their acoustic properties in real-time. For instance, with the help of sensors and artificial intelligence, sound barriers can identify peak noise times and automatically enhance their sound absorption capabilities. This allows for a dynamic response to noise levels, ensuring that local communities experience minimal disruption from sports activities, while organizations can maintain high levels of participation and enjoyment.

SportSonicGuard.com is at the forefront of this technological revolution, offering tailored sound barrier solutions specifically designed for sports environments. Their innovative systems not only reduce noise but also integrate seamlessly into the aesthetic of the facility. By focusing on both functionality and visual appeal, these advanced solutions open up new possibilities for sports venues to thrive in residential areas without compromising on the quality of play or overall experience.

Applications in Sports Activities

Innovative sound barrier solutions have become increasingly vital in sports activities, particularly in urban environments where noise pollution can disrupt communities. SportSonicGuard.com specializes in advanced technologies that effectively mitigate noise generated from popular sports like pickleball and tennis. By implementing these solutions, facilities can ensure a peaceful atmosphere for nearby residents while allowing players to enjoy their games without worrying about excessive sound levels.

The design of SportSonicGuard’s products caters specifically to the unique demands of each sport. For example, in pickleball, where the sound of paddles hitting balls can be particularly loud, specialized barriers absorb sound waves while maintaining visibility for spectators. These solutions not only enhance the experience for players but also foster a more inviting environment that encourages participation and community engagement in sports activities.

Moreover, the versatility of these sound barrier solutions extends beyond traditional sports courts. Facilities can implement them in multi-purpose venues, where noise control is essential in accommodating various events and activities. By adopting advanced sound barrier technologies, sports facilities can create an ideal setting that balances athletic performance with community well-being, ultimately enhancing the overall experience for everyone involved.

Benefits of Sound Barrier Solutions

Sound barrier solutions offer a remarkable opportunity to enhance the quality of life in communities where sports activities, such as pickleball and tennis, take place. By significantly reducing noise levels, these solutions create a more peaceful environment for residents while allowing athletes to enjoy their games without disturbing the surrounding area. This balance promotes harmony between recreational enjoyment and community well-being.

Moreover, the implementation of sound barriers can lead to increased participation in sports. When noise is minimized, players and spectators are more inclined to gather for events, fostering a sense of community. This encourages a vibrant sports culture, where individuals of all ages can connect through shared activities without the concerns of excessive noise detracting from their experience. Increased foot traffic and engagement can also contribute positively to local businesses and event hosting opportunities.

Additionally, advanced sound barrier solutions, such as those offered by SportSonicGuard.com, are designed with both effectiveness and aesthetics in mind. These solutions not only perform exceptionally in noise reduction but can also enhance the visual appeal of a sports facility. This consideration for design ensures that sound barriers are compatible with the environment, allowing for a seamless integration that supports local landscapes and enhances overall community aesthetics.

Future of Noise Control in Sports

As the popularity of sports like pickleball and tennis continues to rise, the need for effective noise control solutions has become paramount. Facilities are increasingly recognizing that high noise levels can detract from the enjoyment of both players and spectators. Innovative products from companies like SportSonicGuard.com are paving the way for a quieter sports environment. These advanced sound barrier solutions are not only essential for maintaining an enjoyable atmosphere but also play a critical role in minimizing disruptions to surrounding communities.

The future of noise control technology in sports will revolve around sustainability and adaptability. By incorporating eco-friendly materials and designs, manufacturers can create sound barriers that not only perform well but also align with modern environmental standards. Additionally, as sports facilities evolve, there will be a growing demand for customizable solutions that can be tailored to specific venue requirements. This adaptability will ensure that noise control strategies remain effective, regardless of the changing dynamics within sports environments.

Looking ahead, collaboration between sports organizations, technology developers, and communities will be crucial in shaping effective noise reduction strategies. As awareness of the impacts of noise pollution continues to grow, stakeholders will need to work together to implement solutions that enhance the sports experience while respecting the needs of local residents. Through innovative partnerships and cutting-edge advancements, the future of noise control in sports promises to deliver a more enjoyable and harmonious coexistence between athletes and communities alike.

Navigating the Move: Your Ultimate Guide to Montreal’s Top Moving Companies

Moving to a new city can be both an exciting and daunting experience. Whether you are relocating for personal reasons, a new job opportunity, or simply seeking a change of scenery, finding the right moving company can make all the difference. In Montreal, a city known for its rich culture and vibrant neighborhoods, choosing a reliable moving service is essential to ensure a smooth transition.

When planning your relocation in Montreal, it’s essential to search for to ensure a smooth transition to your new home.

One company that stands out in the Montreal moving industry is Anber Movers. As a Canadian moving company based in Montreal, Anber Movers has built a solid reputation for their professionalism, efficiency, and commitment to customer satisfaction. In this guide, we will explore some of the top moving companies in Montreal, highlighting their services, strengths, and what makes them the best choice for your upcoming move. Whether you are moving locally or across the province, we have you covered with the information you need to make an informed decision and navigate your move with ease.

When searching for reliable assistance in your relocation to Montreal, it’s helpful to look for Business Moving Companies Near Me to ensure a smooth transition to your new home.

About Anber Movers

Anber Movers is a leading Canadian moving company based in Montreal, known for its exceptional customer service and reliability. With years of experience in the moving industry, they have built a strong reputation for ensuring that every move is smooth and efficient. Their team consists of skilled professionals who are committed to handling personal belongings with the utmost care and respect, making them a popular choice among residents looking to relocate within the city or beyond.

One of the standout features of Anber Movers is their comprehensive range of services. Whether you need help with residential moving, commercial relocation, or specialized services such as piano moving, Anber Movers has the expertise to accommodate various needs. They provide customized solutions tailored to individual preferences, which helps to alleviate the stress that often comes with moving. Their attention to detail and dedication to customer satisfaction set them apart in the competitive Montreal market.

Anber Movers also prioritizes transparency and affordability in their pricing structure. Clients can expect clear quotes with no hidden fees, allowing for better budget planning. Additionally, they offer flexible scheduling options to suit clients’ timelines. By combining quality service with competitive pricing, Anber Movers has established itself as a trusted choice for anyone planning a move in Montreal.

Services Offered

Anbermovers provides a comprehensive range of services to meet the diverse needs of its clients in Montreal. Whether you are relocating your home or need assistance with a commercial move, their team is equipped to handle it all. They offer packing and unpacking services, which can be a lifesaver for busy individuals or families who prefer to avoid the hassle of loading boxes themselves. Additionally, Anbermovers also provides secure storage solutions for those who require a temporary place for their belongings during the transition.

In the realm of residential moving, Anbermovers excels at ensuring a smooth and efficient process. Their experienced movers are trained to handle everything from delicate antiques to heavy furniture, ensuring that all items are transported safely. They understand the unique challenges of navigating the streets of Montreal, particularly in busy neighborhoods, and customize their approach to suit each client’s specific requirements. With attention to detail and a commitment to customer satisfaction, Anbermovers makes every effort to minimize stress during your move.

For businesses looking to relocate, Anbermovers offers specialized commercial moving services tailored to reduce downtime and maintain productivity. They work closely with companies to create a moving plan that minimizes disruption to daily operations. Their teams are adept at handling office equipment, ensuring that technology and sensitive materials are transported with care. Whether you are moving a small office or an entire corporate headquarters, Anbermovers provides reliable service that aligns with your business needs.

Customer Reviews

Customers frequently highlight Anber Movers as a reliable choice for their moving needs in Montreal. Many have praised the professionalism and efficiency of the moving team, noting how they handled both large and delicate items with care. Positive feedback often emphasizes the punctuality of the crews, which sets a reassuring tone for those nervous about their moving day.

Another aspect that stands out in the reviews is the transparent pricing model offered by Anber Movers. Clients appreciate the detailed quotes, which help to eliminate any surprise costs on moving day. This approach not only builds trust but also allows customers to plan their budgets more effectively, making the entire moving process smoother and less stressful.

Additionally, several reviews mention the exceptional customer service provided by Anber Movers. Many customers have shared their experiences with the company’s staff, highlighting their willingness to answer questions and address concerns before, during, and after the move. This level of support contributes to a positive moving experience, encouraging many to recommend Anber Movers to friends and family.

Conclusion

Choosing the right moving company in Montreal can significantly impact the ease of your relocation. With various options available, it is crucial to consider factors such as reputation, services offered, and customer feedback. Among the prominent names, Anbermovers stands out as a reliable Canadian moving company dedicated to providing exceptional service to its clients.

Planning your move well in advance can help streamline the process and reduce stress. Make sure to communicate your specific needs to your chosen moving company and ask questions to clarify any uncertainties. This approach ensures that your expectations align with the services provided, giving you peace of mind as you prepare for this important transition.

Ultimately, investing time in selecting the right moving partner like Anbermovers can lead to a smoother, more organized move. By considering your options carefully and leveraging the expertise of experienced movers, you can make navigating your move in Montreal a positive experience.

Elevate Your Home: The Ultimate Guide to Siding, Roofing, Gutters, and Windows

When it comes to enhancing the aesthetic appeal and functionality of your home, the exterior elements play a crucial role. Siding, roofing, gutters, guards, and windows not only provide protection from the elements, but they also contribute significantly to your home’s curb appeal and energy efficiency. Understanding the importance of these components is the first step towards elevating your home’s overall value and comfort.

In this ultimate guide, we will explore the various options and styles available for siding, the essential aspects of roofing, how effective gutters and guards can protect your home, and the impact of windows on energy consumption and natural light. Whether you are planning a complete home renovation or just looking to make small improvements, this guide will help you navigate the choices that best suit your needs. Let’s dive into these key elements that can transform your living space into a more beautiful and efficient haven.

Choosing the Right Siding

Selecting the right siding for your home is crucial for both aesthetic appeal and durability. With a variety of materials available, such as vinyl, wood, fiber cement, and metal, it’s important to consider factors like your home’s architectural style, climate, and maintenance requirements. Each material offers distinct benefits; for instance, vinyl siding is low-maintenance and cost-effective, while wood siding provides a natural, warm look that can enhance curb appeal.

In addition to material, color and texture are key elements that can transform your home’s exterior. Lighter colors may reflect heat and help keep your home cooler in warmer climates, while darker hues can absorb heat and add a striking visual contrast. Exploring different textures, such as smooth, textured, or even patterned options, can also add depth and interest to your home’s facade.

https://www.tlhomeimprove.com/

Budget is another significant factor in choosing siding. Consider not only the initial cost of materials but also installation expenses and long-term maintenance. While some options may require higher upfront costs, they can provide greater energy efficiency and lower maintenance needs over time. Ultimately, balancing personal preference with practical considerations will lead you to the perfect siding choice for your home.

Roofing Options and Benefits

When it comes to roofing, homeowners have a variety of options to choose from, each with unique advantages. Asphalt shingles remain one of the most popular choices due to their cost-effectiveness, durability, and ease of installation. Available in a range of colors and styles, they can enhance the aesthetic of any home while providing reliable protection from the elements. For those seeking a more long-lasting solution, metal roofing has gained popularity for its longevity and resistance to harsh weather conditions. Metal roofs can also be energy-efficient, reflecting heat and reducing cooling costs.

Another excellent option is slate roofing, known for its timeless beauty and exceptional durability. Slate can last over a century, making it a wise investment for homeowners looking for longevity and low maintenance. However, the initial cost may be higher than other materials. Clay or concrete tiles are also notable choices that offer a unique look while providing excellent insulation and fire resistance. These materials can be ideal for homes in warm climates, as they help to manage indoor temperatures effectively.

Beyond aesthetics and durability, roofing options also contribute to energy efficiency. Many modern roofing materials come with reflective coatings designed to minimize heat absorption, ultimately leading to lower energy bills. Proper roofing can also improve ventilation in the home, which protects against moisture buildup and promotes better indoor air quality. When considering roofing, it’s essential to weigh these benefits to select the best option that fits your lifestyle and budget.

Gutters and Windows: Essential Features

Gutters play a crucial role in protecting your home from water damage. They channel rainwater away from your roof and foundation, preventing issues like mold growth and structural deterioration. When selecting gutters, consider materials such as aluminum, vinyl, and copper, each offering unique benefits in terms of durability and maintenance. Additionally, the size and shape of your gutters should be tailored to your local climate and rainfall patterns, ensuring optimal performance throughout the year.

Windows are another vital component of your home’s exterior. They not only enhance your property’s aesthetic appeal but also contribute to energy efficiency. Modern windows come equipped with features such as double or triple glazing, low-emissivity (Low-E) coatings, and gas fills that improve insulation. Choosing the right style, whether it’s casement, sliding, or bay windows, can also impact both the interior comfort and exterior look of your home.

Incorporating efficient gutters and high-quality windows can greatly elevate your home’s value and functionality. When both elements work together effectively, they help maintain a healthy living environment while safeguarding your property against weather-related issues. By investing in these essential features, you can enjoy peace of mind and enhance the overall appeal of your home for years to come.

Time’s Ticker: Revolutionizing Work with Smart Clocking In Machines

In today’s fast-paced work environment, efficiency and accountability are paramount. With the advent of technology, traditional methods of tracking employee attendance are becoming outdated. Enter clocking in machines, the innovative devices that are transforming how organizations manage time and attendance. These smart solutions not only streamline the process of clocking in and out but also offer a range of features that enhance productivity and simplify administrative tasks.

In today’s fast-paced work environment, organizations are increasingly turning to advanced solutions like Labor Management Systems to enhance efficiency and accountability in tracking employee attendance.

As businesses strive to optimize their operations, clocking in machines are emerging as indispensable tools. They provide real-time data on employee hours, ensuring accurate payroll processing while reducing the likelihood of human error. With functionalities like biometric recognition and mobile accessibility, these machines are paving the way for a more transparent and reliable approach to workforce management. The shift towards these smart systems is more than just a trend; it represents a fundamental change in how we view time at work.

Understanding Clocking In Machines

Clocking in machines are innovative tools designed to streamline the process of employee attendance tracking. These devices have evolved from traditional time clocks that simply recorded when employees started and ended their shifts. Modern clocking in machines offer advanced features like biometric recognition, RFID scanning, and mobile integration, making it easier for businesses to monitor work hours accurately and efficiently.

The primary function of clocking in machines is to ensure precise attendance records. This not only helps in payroll processing but also aids in managing labor costs and complying with labor laws. With automation replacing manual entry, these machines reduce the likelihood of errors associated with human input, benefiting both employers and employees by providing a clear and reliable record of hours worked.

In addition to attendance tracking, many clocking in machines now come equipped with additional functionalities such as scheduling, reporting, and integration with existing human resources software. This enhanced capability allows managers to efficiently oversee their workforce, analyze attendance patterns, and make informed decisions that can improve productivity and employee satisfaction.

Benefits of Smart Technology

Smart technology in clocking in machines offers unparalleled accuracy in attendance tracking. Traditional methods often rely on manual input, which can lead to errors and inconsistencies. With advanced biometric recognition or smart card systems, organizations can ensure that every clock-in and clock-out is precisely recorded, reducing time theft and enhancing accountability among employees.

Another significant benefit is the increased efficiency in payroll processing. Integrating these smart machines with payroll systems allows for real-time data collection, streamlining the management of employee hours. This automation minimizes administrative workload, enabling human resources teams to focus on more strategic initiatives rather than time-consuming manual calculations.

Furthermore, smart clocking in machines can provide valuable insights through data analytics. By analyzing attendance patterns and productivity levels, managers can identify trends and optimize scheduling. This data-driven approach fosters a more agile organization, making it easier to adapt to workforce needs and improve overall operational efficiency.

Implementing Clocking In Systems

Integrating clocking in machines into a workplace requires careful planning and execution to ensure a smooth transition and maximized benefits. The first step is to evaluate the specific needs of the organization, which includes understanding employee workflows, the frequency of clocking in and out, and any existing systems that may need to be integrated. It is also crucial to involve employees in the discussion to address any concerns and gather input, which can lead to higher acceptance of the new technology.

Once the requirements have been established, selecting the right type of clocking in machines becomes essential. There are various options available, from biometric scanners to mobile applications, each offering unique features tailored to different work environments. Organizations should consider factors such as scalability, data security, and ease of use. It is also important to determine the necessary infrastructure, such as internet connectivity or electrical requirements, to support the machines effectively.

The final stage of implementation focuses on training and support. Providing comprehensive training for employees and management ensures everyone understands how to use the machines properly. Continuous support is vital for addressing any technical issues that may arise post-implementation. By fostering an environment of open communication regarding the clocking in processes, organizations can enhance employee satisfaction and streamline attendance tracking, leading to increased efficiency across the board.

Case Studies: Success Stories

One notable success story comes from a manufacturing company that implemented smart clocking in machines at its production facilities. Previously, the manual timekeeping system was a significant source of errors, leading to payroll discrepancies and decreased employee morale. After the installation of the new system, the accuracy of time tracking improved remarkably. Employees appreciated the convenience of simply clocking in with a biometric scan, which reduced time theft and attendance issues. As a result, the company not only saved on labor costs but also fostered a more positive workplace culture.

Another impressive example is a technology firm that utilized smart clocking in machines to streamline their remote working processes. With many employees working from home, the traditional clocking in method became impractical. The firm adopted a digital clocking system that integrated seamlessly with their existing project management software. Employees were able to log their hours directly on the platform, which automatically matched their time with project timelines. This innovation led to enhanced productivity, as team leaders gained clearer insights into each member’s time allocation and project progress.

Finally, a large retail chain decided to embrace smart clocking in machines in their stores, resulting in significant operational efficiencies. The clocking in machines were equipped with scheduling features that automatically adjusted shifts based on real-time customer traffic data. Employees were able to clock in and out effortlessly, while the management team saved countless hours previously spent on scheduling conflicts and overtime calculations. This shift not only improved employee satisfaction by providing more predictable work hours but also enhanced customer service, as stores were better staffed during peak times.

Future Trends in Workforce Management

The integration of advanced technologies into workforce management is transforming how organizations approach employee attendance and productivity. Smart clocking in machines are at the forefront of this trend, offering features like biometric authentication and real-time data analytics. These innovations not only streamline the clocking in process but also enhance security and reduce the risk of time theft, ensuring that organizations manage their workforce more effectively than ever.

As remote work continues to gain traction, the need for flexible clocking in solutions is becoming paramount. Future smart clocking in machines are likely to incorporate mobile applications that allow employees to check in from various locations, ensuring that productivity tracking remains seamless regardless of where work is performed. This adaptability will empower organizations to manage hybrid work models without compromising oversight and accountability.

Moreover, artificial intelligence and machine learning will play a crucial role in the evolution of clocking in systems. Predictive analytics may inform decision-making regarding workforce allocations and scheduling, helping organizations optimize labor costs while enhancing employee satisfaction. As these technologies evolve, clocking in machines will not only track attendance but also contribute to a broader strategy of workforce management, aligning employee performance with organizational goals.

Strands of Confidence: Elevate Your Hair Care Routine

Your hair is often a reflection of your personal style and well-being. Whether you’re rocking long flowing locks or a chic bob, maintaining healthy and vibrant hair can dramatically enhance your overall appearance and boost your confidence. In a world where first impressions matter, investing time in your hair care routine can be as essential as choosing the right outfit or perfect accessory.

Elevating your hair care routine is not just about the products you use; it’s also about understanding your hair type, its needs, and how to nurture it effectively. With so many options available, from nourishing shampoos to deep conditioning treatments, it can be overwhelming to figure out what works best for you. This guide aims to provide insights and practical tips that will transform your hair from dull to dazzling, helping you feel empowered and confident with every strand.

Understanding Your Hair Type

Understanding your hair type is essential for building an effective hair care routine. Hair types can broadly be categorized into straight, wavy, curly, and coily. Each type has unique characteristics that influence how it responds to various hair care products and techniques. Identifying your hair type is the first step towards achieving healthy, vibrant hair tailored to your needs.

Alongside the texture, the density and porosity of your hair play critical roles in determining how you should care for it. Hair density refers to how many strands of hair you have on your scalp, while porosity indicates how well your hair absorbs and retains moisture. Knowing whether you have low, medium, or high porosity helps in selecting the right products, ensuring that your hair stays hydrated and healthy.

Finally, your scalp condition also influences your hair care routine. An oily scalp may require lighter products, while a dry scalp might benefit from moisturizing treatments. By understanding your hair type, density, porosity, and scalp condition, you can make informed decisions that elevate your personal care routine, leading to healthier and more manageable hair.

Essential Hair Care Products

When it comes to maintaining healthy hair, selecting the right products is crucial. A good shampoo is the foundation of any hair care routine. Look for a sulfate-free formula that suits your hair type, whether it’s oily, dry, or color-treated. These shampoos cleanse without stripping the hair of its natural oils, helping to retain moisture and shine. Remember to wash your hair in lukewarm water to prevent damage and keep it looking vibrant.

Conditioner is another essential product that hydrates and nourishes your strands. A quality conditioner will help to detangle your hair, making it more manageable and less prone to breakage. Leave-in conditioners and deep conditioning masks are also beneficial for those with dry or damaged hair. Incorporating these into your routine can significantly improve the overall texture and appearance of your hair.

Finally, styling products play a vital role in protecting and enhancing your hair. Heat protectants are a must if you frequently use heat styling tools, as they provide a barrier against damaging temperatures. Additionally, serums and oils can add shine and further promote smoothness. Choose products that align with your hair’s needs to elevate your personal care game, achieving strands that radiate confidence.

Daily Hair Care Routine

A well-structured daily hair care routine is essential for maintaining healthy and vibrant hair. Start your day with a gentle cleansing shampoo that suits your hair type. Whether you have dry, oily, or color-treated hair, choose a product that addresses those specific needs. Massage the shampoo into your scalp to promote circulation, and rinse thoroughly to remove any buildup. This initial step sets the foundation for a thriving mane, ensuring that you wash away impurities while keeping your hair moisturized.

After cleansing, condition your hair to replenish moisture and enhance smoothness. Apply a generous amount of conditioner from mid-length to ends, as this is where hair tends to be drier and more prone to damage. Allow the conditioner to sit for a few minutes to deeply penetrate the strands. This simple addition to your routine can make a world of difference, leaving your hair feeling soft and manageable throughout the day.

To finish your daily hair care routine, gently towel-dry your hair and consider applying a lightweight leave-in conditioner or serum. This will help protect your hair from environmental stressors and reduce frizz. As you style your hair, opt for heat protectant products if you’re using styling tools, to keep your locks safe from heat damage. Consistently following this routine will not only enhance the look and feel of your hair but also boost your confidence as you embrace your personal care journey.

DIY Hair Treatments

Creating your own hair treatments at home can be a fun and rewarding way to nourish your tresses without breaking the bank. One popular option is a coconut oil mask. Simply warm a few tablespoons of coconut oil until it’s melted, then massage it into your hair from roots to tips. Cover your hair with a shower cap and leave it on for at least 30 minutes, allowing the oils to penetrate deeply. Rinse it out with shampoo and enjoy the added shine and moisture.

Another effective DIY treatment is a yogurt and honey mask. Combine half a cup of plain yogurt with two tablespoons of honey for a moisturizing boost. Yoghurt is rich in proteins that strengthen hair, while honey acts as a natural humectant, attracting moisture. Apply this mixture to damp hair and leave it on for about 20 minutes before rinsing thoroughly. This treatment can help to make your hair softer and more manageable.

For those looking to revitalize their scalp, a tea tree oil treatment can work wonders. Mix a few drops of tea tree oil with a carrier oil such as olive or almond oil. Massage this blend into your scalp and let it sit for 20 minutes before washing it out. Tea tree oil has antibacterial properties that can help with dandruff and itching, promoting a healthier scalp environment. Regular use of this treatment can enhance overall hair health and appearance.

Tips for Healthy Hair Growth

To achieve healthy hair growth, it’s important to maintain a balanced diet rich in vitamins and minerals. Incorporate foods high in omega-3 fatty acids, such as salmon and walnuts, as well as leafy greens and fruits that are packed with antioxidants. Biotin and vitamin E are also crucial, so consider including eggs and avocados in your meals. Staying hydrated by drinking plenty of water can significantly improve the overall health of your hair and scalp.

Regular trimming is another key aspect of promoting healthy hair growth. While it may seem counterintuitive, getting rid of split ends and damaged hair prevents further breakage, allowing your hair to grow stronger and healthier over time. Aim for a trim every six to eight weeks to maintain your hair’s integrity and encourage a fuller appearance. This routine creates an opportunity to reassess your hair care practices and make any necessary adjustments.

Lastly, avoid excessive heat styling and harsh chemical treatments, as these can lead to weakened strands and hinder growth. Instead, embrace natural drying methods and use heat protectants when styling is necessary. Additionally, consider incorporating scalp massages into your routine to stimulate circulation and promote healthy follicles. These simple yet effective strategies can transform your hair care regimen and significantly enhance your hair’s growth potential.

- « Previous Page

- 1

- …

- 64

- 65

- 66

- 67

- 68

- …

- 400

- Next Page »